China spends big on Samsung, SK Hynix chips in first half amid US sanctions fears

- Samsung’s chip sales to China increased 82 per cent in the first half, and SK’s increased 122 per cent, as companies stockpile semiconductors

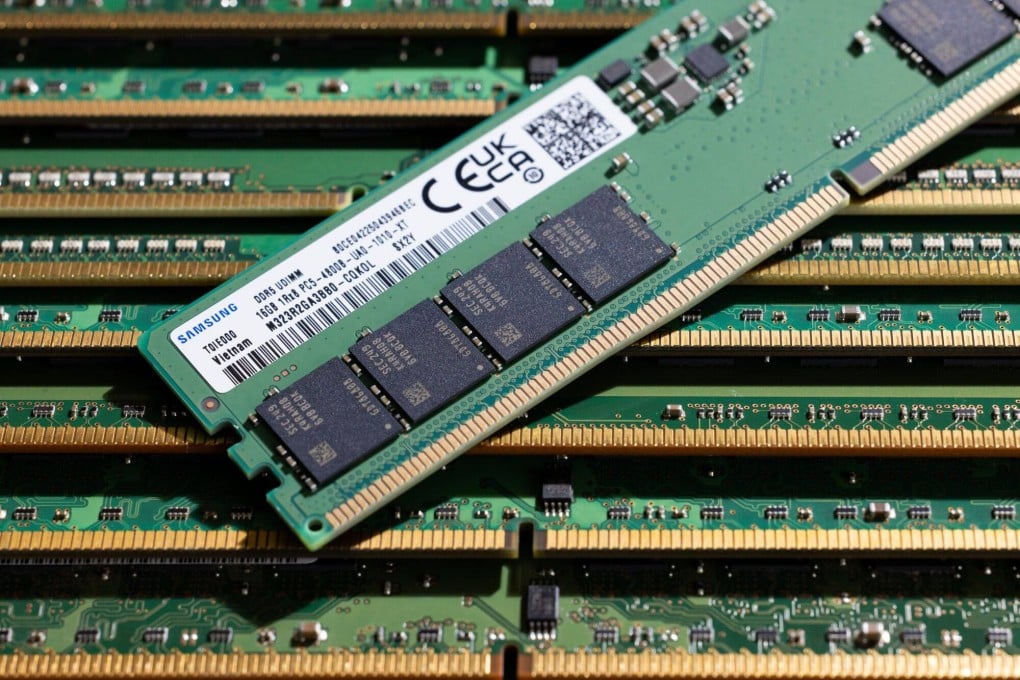

Samsung reported an 82 per cent rise in revenue from China year on year to 32.35 trillion won (US$24.1 billion) in the first six months of the year, according to data from the company’s first-half financial results published last week. China accounted for about 31 per cent of Samsung’s regional revenue of 104.9 trillion won, which grew 28 per cent from the same period a year earlier.

SK Hynix also reported a China sales surge, with revenue from clients in the country jumping 122 per cent to 8.6 trillion won, accounting for 30 per cent of its 28.8 trillion won in total revenue for the first half, according to data from the company’s financial report, also filed last week. SK is a major supplier of advanced memory chips known as high-bandwidth memory (HBM).

SK Hynix made more than 95 per cent of its revenue from memory chips. Samsung’s sales to China also include smartphones and home appliances, in addition to chips.

The sales surge comes amid speculation that Washington may further restrict China’s access to advanced chips and other technologies from the US and its allies. Chinese importers are under pressure to stockpile certain products before new restrictions are unveiled, according to analysts.