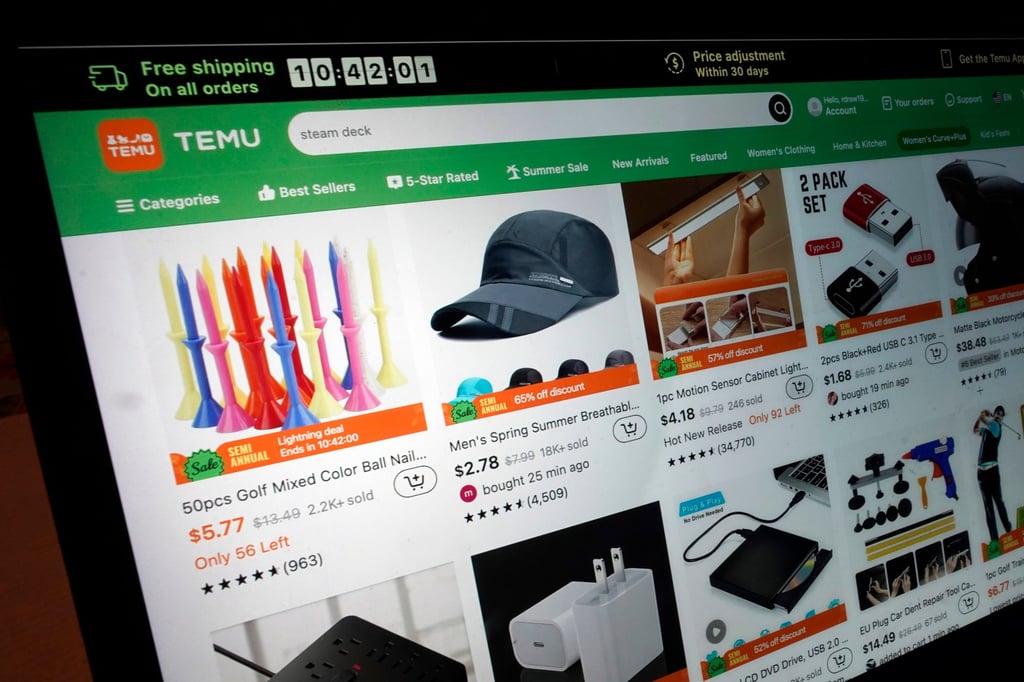

Temu sellers struggle with disputes amid complex company structure outside China

- Sellers on the app from China’s PDD Holdings are finding it difficult to resolve disputes over withheld earnings, which must be done outside the mainland

Merchants sign agreements with Temu through its operator Whaleco’s entities in either Dublin or Boston, depending on where they sell, according to sellers and the platform’s official website. These agreements specify that disputes must be submitted to the Hong Kong International Arbitration Centre, placing them outside the jurisdiction of domestic judicial and regulatory bodies.

“Given the cross-border nature of these transactions, it’s logical for both parties to agree on a dispute resolution method and set Hong Kong as the arbitration venue,” said Wu Libin, senior partner at M&T Lawyers. “However, many merchants are unfamiliar with Hong Kong’s legal framework, and the high costs of litigation pose a significant barrier to seeking legal remedies.”

Merchants said that the company’s agreements disadvantage them, with updates often appearing as pop-up windows on the seller’s back-end system, requiring immediate consent to continue operations. This has resulted in some cases to hundreds of thousands of dollars in fines and withheld earnings over issues such as alleged intellectual property infringement and poor product quality.

In response, hundreds of suppliers stormed the office of Temu logistics affiliate in Guangzhou.