Advertisement

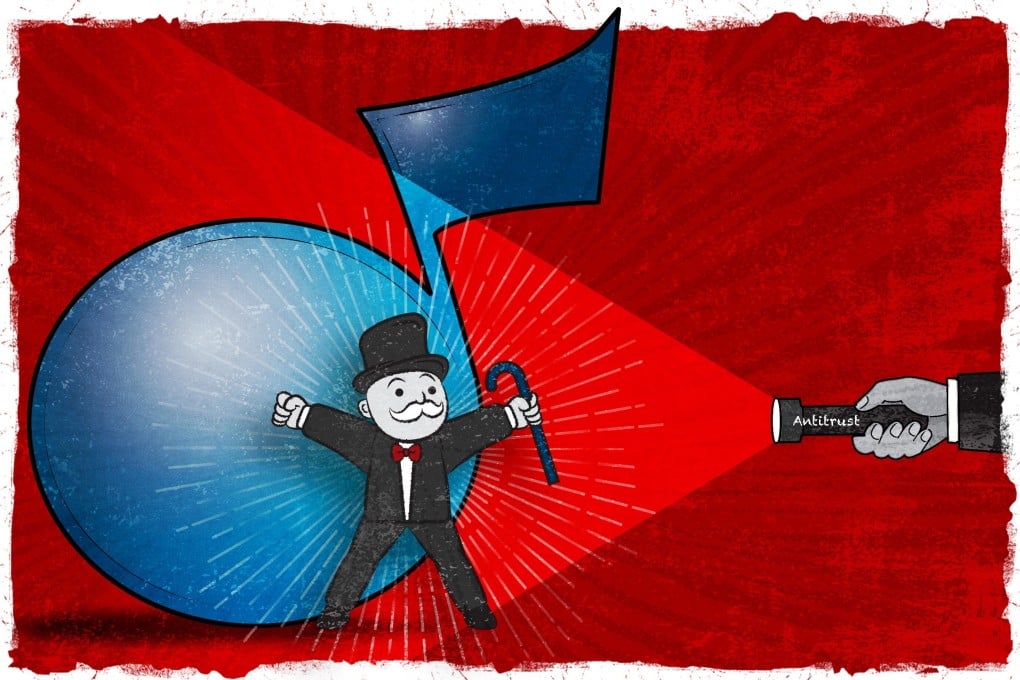

China antitrust: Tencent’s outsized share of online music-streaming market could put its holdings at risk

- Tencent Music Entertainment Group operates popular apps QQ Music, Kugou Music and Kuwo Music in China

- The New York-listed company has more than 30 million tracks licensed from domestic and international music labels

Reading Time:6 minutes

Why you can trust SCMP

3

In the first of a four-part series on China’s antitrust investigations into the nation’s internet and technology sectors, Xinmei Shen and Coco Feng look at the music-streaming services provided by online platforms. Parts two through four on video games, literature and ride-hailing will be published on May 29, June 12 and June 26.

Advertisement

With an eye to rein in the power and influence of China’s Big Tech companies, Beijing dropped the hammer on e-commerce industry leader Alibaba Group Holding in April with a record US$2.8 billion fine for antitrust violations, following that up with an investigation of on-demand delivery services giant Meituan.

Other major hi-tech firms are now expected to come under the government’s antitrust scrutiny. Regulators are already preparing to slap penalties on Tencent Holdings, whose dominance in online music-streaming services has been the focus of a government inquiry, according to a recent Reuters report.

Shenzhen-based Tencent, which runs the world’s largest video gaming business by revenue and China’s top social media platform WeChat, also controls the country’s biggest music-streaming operation. New York-listed Tencent Music Entertainment Group (TME), in which Spotify is a principal shareholder, operates popular apps QQ Music, Kugou Music and Kuwo Music, with a combined 622 million monthly active users (MAUs) in the December quarter last year.

Advertisement

By comparison, closest competitor NetEase Cloud Music – operated by NetEase, China’s second-largest video games company – had about 150 million MAUs in the same period, according to estimates by QuestMobile and Deutsche Bank.

Tencent could face penalties for not properly reporting past acquisitions and investments for antitrust review, which might force it to sell its Kugou and Kuwo apps, according to a Reuters report last month, citing people familiar with the matter.

Advertisement