US-China tech war: Huawei’s chip unit HiSilicon to see massive decline in 5G chip market this year

- HiSilicon, which had 23 per cent of the 5G phone chipset market in 2020, is expected to see that share shrink to less than 5 per cent this year

- MediaTek, which designs processors for mobile applications, is the major supplier to Chinese smartphone vendors like Xiaomi, Oppo and Vivo

The decline of HiSilicon’s business is a direct result of the US government’s tightened sanctions last summer, barring semiconductor companies from supplying Shenzhen-based Huawei with chips made using US technology without prior approval, effectively severing the Chinese telecom giant’s access to advanced semiconductors.

Huawei did not immediately reply to a request for comment.

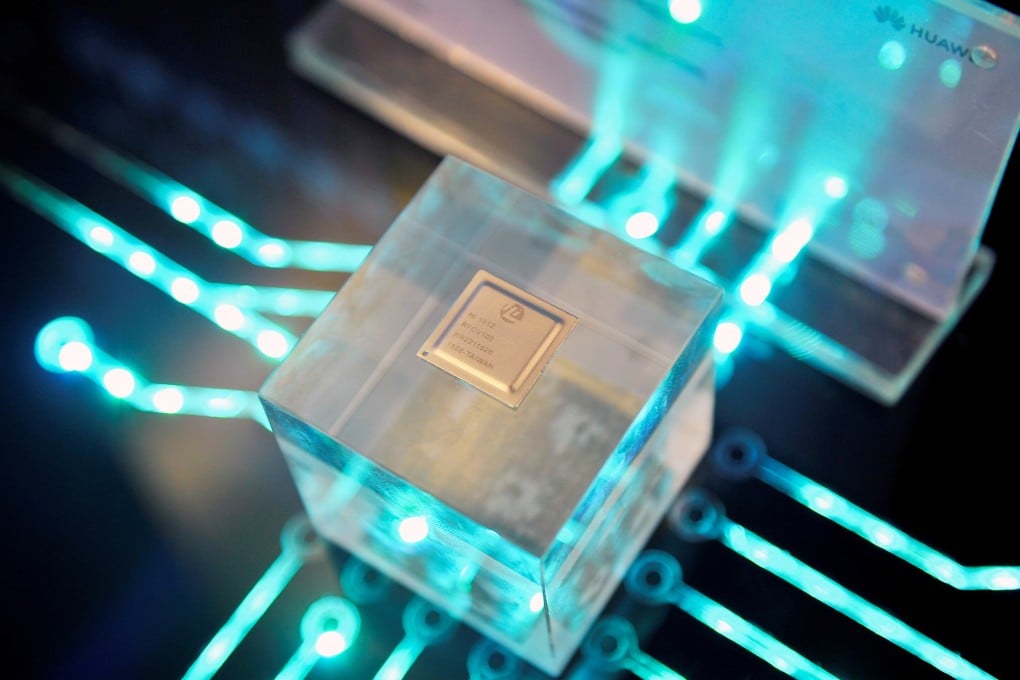

HiSilicon was responsible for designing the Kirin processors for Huawei‘s smartphones. However, as the company has no chip manufacturing capacity of its own, it outsourced wafer fabrication to foundries like Taiwan Semiconductor Manufacturing Co (TSMC). But under the tighter US sanctions, HiSilicon can no longer do business with TSMC or other foundries because they all rely to some extent on core US technology to make wafers.

HiSilicon’s loss has been MediaTek’s gain, with the fortunes of the Taiwan-based chip designer rising amid US-China tech tensions. This year, MediaTek retained its top spot in the so-called fabless chip maker rankings over US-based Qualcomm, Counterpoint research shows.