Opinion | China’s semiconductor gold rush: A reality check

- Even with enough capital investment, it might take the better part of a decade for China to catch up with TSMC

- Just a handful of Japanese companies dominate the global market in silicon wafers, photoresists, and essential packaging chemicals

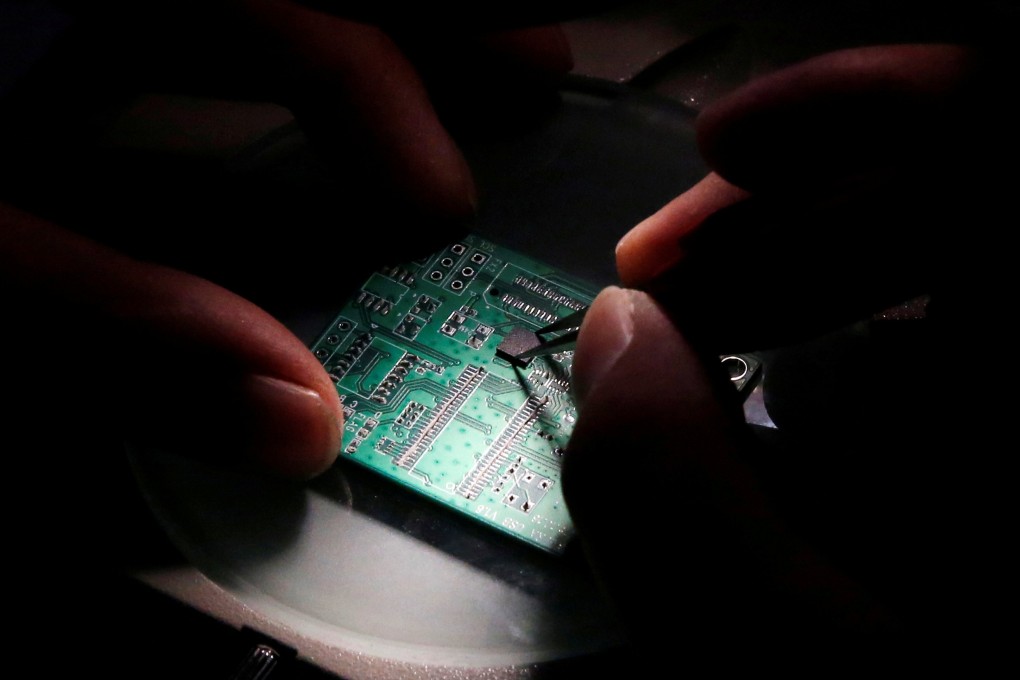

The semiconductor industry has become a major front in the US-China tech war. Given that this is a weak link in China’s otherwise impressive technology stack, the US has imposed export controls restricting Chinese semiconductor companies from accessing key equipment, software, and intellectual property.

China has been aware of this weak link. Since 2014, the Chinese state set up two “Big Funds” to raise money primarily from government bodies – the finance ministry, state-owned enterprises, local governments – and invest it in upcoming semiconductor companies.

The government-led investment has led to a “crowding-in” of private enterprise. More than 13,000 Chinese enterprises registered as semiconductor companies in the first nine months of this year, according to Qichacha, a database of information on Chinese companies. That is a significant jump from the nearly 9,000 companies that registered last year. Such is the lure that several new entrants with no prior experience in semiconductors have thrown their hat into the ring.

Does this silicon rush mean that China will become self-sufficient in semiconductors soon? Not quite. China’s state-backed funds may well spur private investment, even producing a few champions, but such moves are unlikely to result in a self-sufficient Chinese semiconductor industry any time soon.

That’s because the semiconductor supply chain is complex. It can be roughly split into three main stages: integrated circuit (IC) design, semiconductor manufacturing, and assembly and testing. The returns of investment for China in each of these stages will be different due to their unique limiting constraints.

IC Design: The first stage is skill-heavy and asset-light. Coming up with newer chip architectures and integrating them requires a large number of high-skilled engineers familiar with specialised software. There were nearly 138,000 design start-ups in China as of September 2020, most of them being registered after the first government-backed fund was announced in 2014. Though there are fears of a talent shortage, government-backed massive investment means that such a shortage could be tackled by poaching talent from Taiwan at higher wages.