Deal or no deal: Hong Kong’s IPO market loses out to New York, Shanghai and Shenzhen rivals

The lack of sizeable deals led average deal sizes at HKEX to decline by almost a third

Given the uncertainties over growth in mainland China’s economy and more US interest rate hikes, total fund raising in Hong Kong in the first quarter of 2017 was lower than in the corresponding period in 2016, and the city lagged behind New York, Shanghai and Shenzhen as the fourth largest initial public offering (IPO) market.

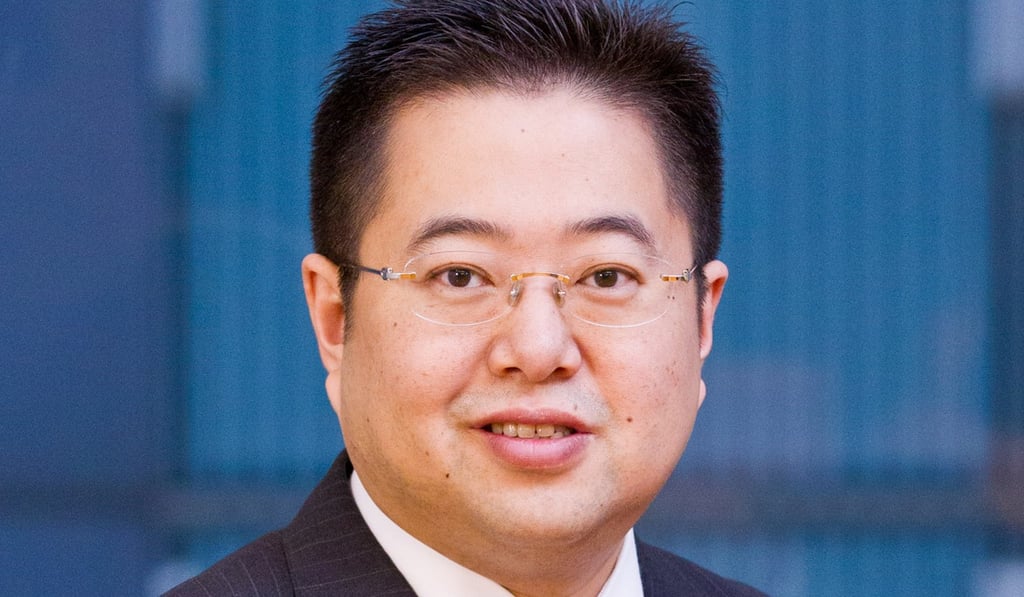

However, there was a tremendous increase in the number of small- to medium-sized floatations. This shows that Hong Kong’s IPO market has remained active and has not been affected by the ramping up of A-share listings, says Benson Wong, entrepreneur group leader, PwC Hong Kong.

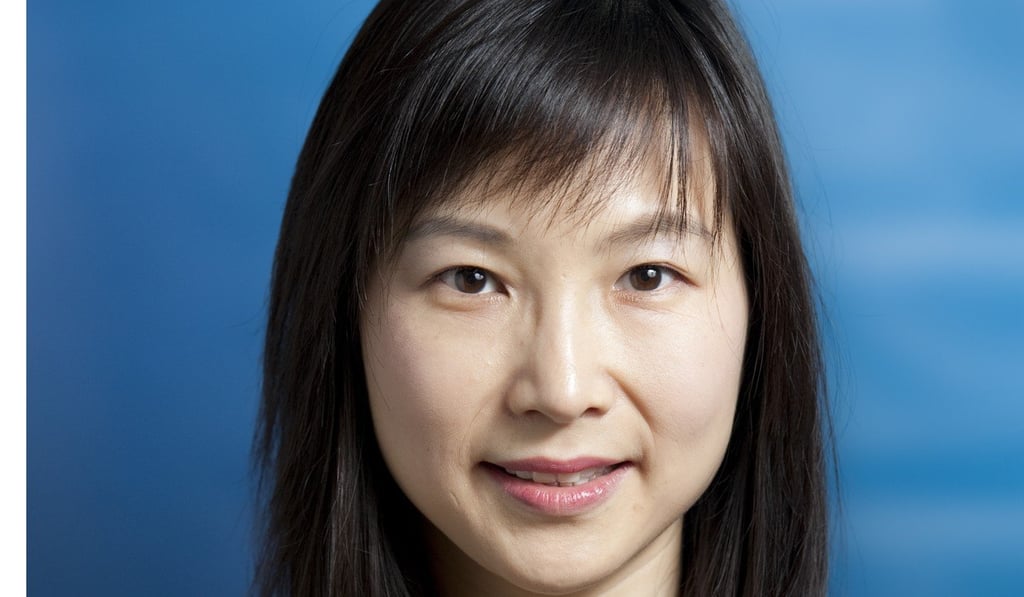

“Still, Hong Kong remains one of the most popular listing destinations,” she says. “We are seeing a greater amount of diversification in both industry and geographical composition. We have seen IPOs from emerging sectors such as education, health care and life sciences this year.

“Meanwhile, more overseas companies, especially from Asean countries, are seeking Hong Kong IPOs. With more than 120 active applications, the outlook for the city’s IPO market remains positive.”

In the first four months, Hong Kong Exchanges and Clearing (HKEX) ranked behind New York Stock Exchange (NYSE), Shanghai Stock Exchange and Shenzhen Stock Exchange, says Ringo Choi, EY’s Asia-Pacific IPO leader. “Thanks to mega IPOs, IPO activity on NYSE has been robust and it raised over US$13 billion in the first four months of 2017, 215 per cent up compared to the first half of 2016.