Hong Kong sells third housing plot on disused airport runway at 12.7 per cent discount, in another sign of property market woes

- Kai Tak Area 4B Site 2 sold to a unit of China Overseas Land & Investment for HK$8.03 billion, or HK$13,523 per square foot

- The latest price tag is a 12.7 per cent discount to the previous plot sold in November, in another clear sign that Hong Kong’s property market has cooled

Hong Kong’s government, which relies on land sales for a substantial part of its revenue, has sold its final residential plot for the year at a 12.7 per cent discount to market valuation, in a further sign of the city’s cooling property market.

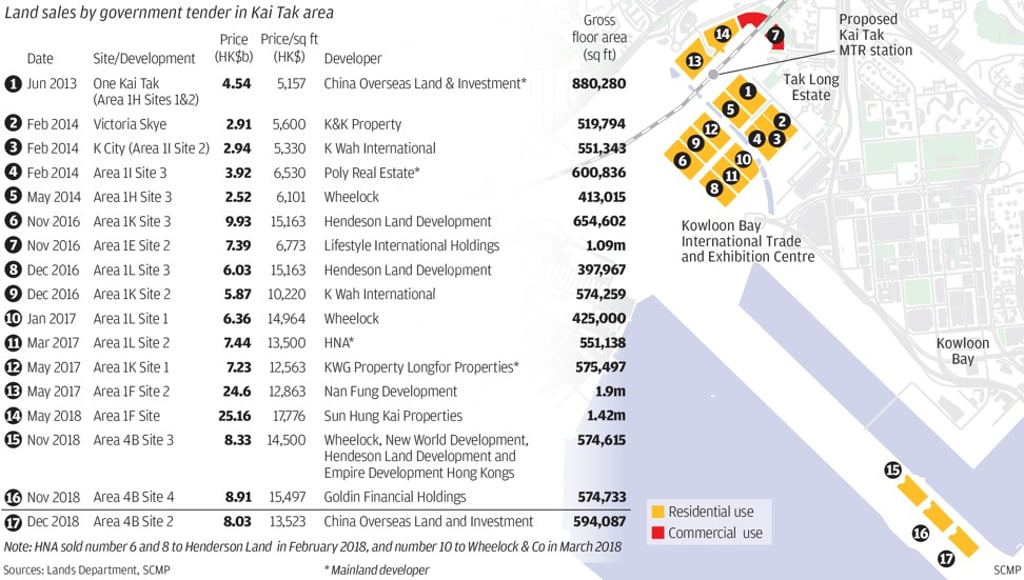

Kai Tak Area 4B Site 2, the third plot for sale on the former airport’s disused runway, sold for HK$8.03 billion (US$1.03 billion) to a unit of China Overseas Land & Investment, according to an announcement by the Lands Department. Six bids were submitted for the tender, which closed last Friday.

Market observers saw the low price as a sign developers are worried that Hong Kong’s stalling housing market will dip further in 2019.

“The price is a bit disappointing,” said James Cheung, executive director of Centaline Surveyors, who had previously valued the parcel of land at HK$15,500 per square foot. “Developers are not as aggressive as they were earlier in the year because the market has softened.”

Thomas Lam, an executive director at Knight Frank, said builders were worried they might have to offer their completed units at lower prices in the coming year.