When following the crowd weakens crowdfunding

A recent study shows that herd-like behaviour could undermine a crowdfunding project, but establishing an all-or-nothing threshold can counteract this effect

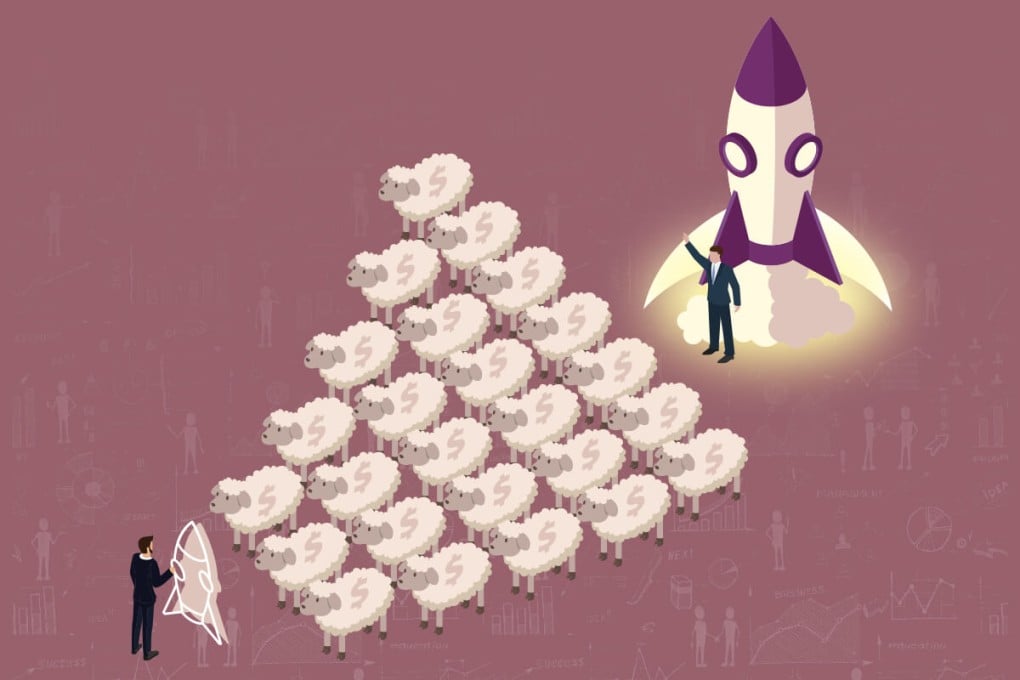

Start-ups often face the challenge of securing funding to scale up their operations. How are they going to get their first bucket of gold? In the modern era, crowdfunding has emerged as an alternative to traditional financing like bank loans or angel investments for its edge to raise funds from a large pool of individuals, while showcasing innovative ideas to a broad audience.

Today, crowdfunding is now a mainstream capital source for entrepreneurs. According to a recent report by Fortune Business Insights, the global crowdfunding market is expected to reach US$3.62 billion by 2030, growing at a compound annual rate of 14.5 per cent.

Comparable with a real-life crowd, economic interactions in crowdfunding platforms normally see investors following others by relying on simple observations to make decisions without pondering their own critical thinking. This phenomenon is called an “information cascade”, which can lead individuals to restrain their true preferences, leading to herd-like behaviour and distorting the perception of project quality. As a result, funded projects attract more backers while unfunded projects struggle to gain traction.

Information cascades can occur in various settings, including financial markets, social media, and consumer behaviour, where individuals are influenced by the actions of others. In crowdfunding, this can result in flawed information gathering as individuals may not contribute their knowledge to the collective process and amplify errors in decision-making, which results in suboptimal outcomes.

To address this issue, a recent study suggests that implementing an all-or-nothing threshold, where the proposer receives all contributions only if the campaign reaches pre-specified funding, can help. This model is an alternative to keep-it-all and partial funding models, where the campaign creator is allowed to retain all or a portion of the funds raised, irrespective of the goal achieved.

“The implementation of all-or-nothing thresholds can improve project feasibility, efficiency and information aggregation,” says Xiao Yizhou, Associate Professor of the Department of Finance of the Chinese University of Hong Kong (CUHK) Business School.