My Take | Elon Musk’s winning bet on Trump offers food for thought in debate over state vs private sector

China does not tolerate people like Musk being deeply involved in politics, but finding the right balance between state and market is tricky

An ancient Chinese story tells how a merchant made one of the most consequential political investments in the country’s history by helping a hostage prince become king. In explaining his rationale to his father, the merchant said, “you can return 10 times your investment by farming, and achieve 100 times return by trading jewellery, but you will have endless returns if you make a king”.

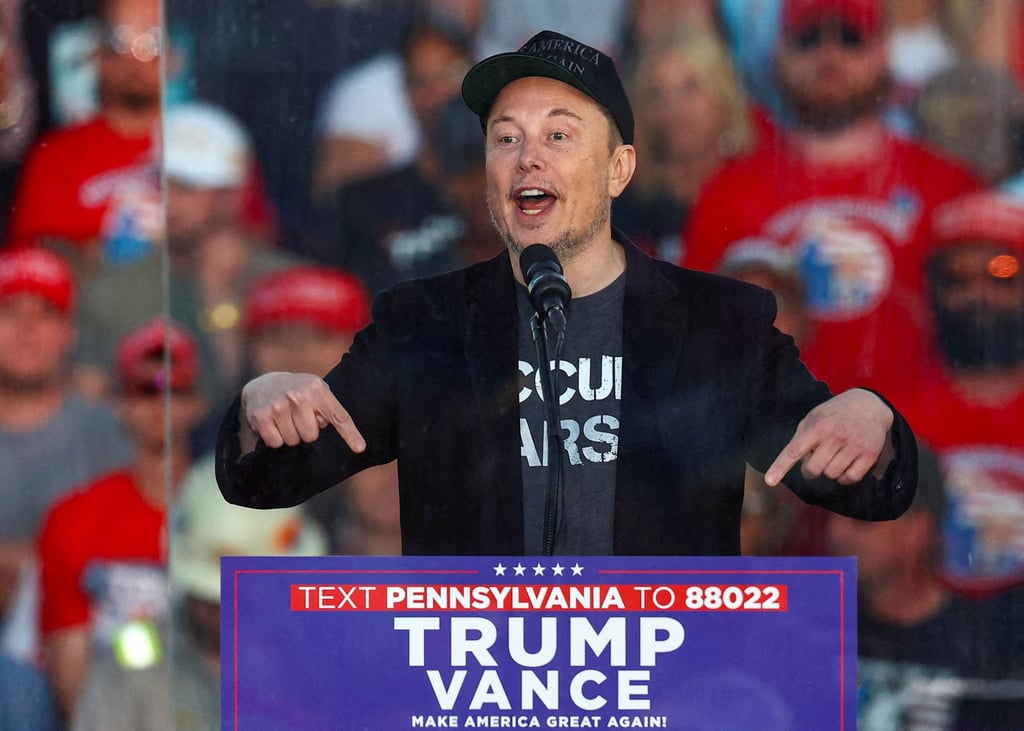

The merchant was Lu Buwei, and the story, which dates back 2,300 years, was recorded in an ancient Chinese history book. After Donald Trump won the US presidential election, many in China have viewed Elon Musk, the founder of Tesla, SpaceX and xAI, as the US version of Lu, as he had the courage to bet heavily on a political candidate. As with Lu in ancient China, Musk’s staunch support of Trump is expected to deliver personal gains as well as having a historic impact.

The relationship between Trump and Musk provides fresh food for thought on ties between merchants and the state in different political and social systems.

In China, the story of Lu didn’t end well. Although Lu had cultivated a king and made himself a powerful prime minister, he was later ousted by the king’s son, Ying Zheng, whose desire for absolute power drove him to conquer other warring states and become the first emperor of China. Lu committed suicide after he was banished by the young king, who had little appetite for sharing power.

The story of Lu is remembered as a cautionary tale instead of an investment success. China’s rulers were reminded to keep an arm’s length from greedy merchants like Lu, and to minimise chances for them to seize a role in history. Many Chinese merchants also learned that they must not meddle with politics. Today, two millenniums after Lu, no Chinese merchant would be foolish enough to claim they had ambitions to chase the “endless” returns from political investment. That would be suicidal.

The lack of political influence and moral recognition in turn make merchants vulnerable to power changes and policy shifts. As a Chinese saying goes, a rich family cannot stay rich for more than three generations. An important reason for this was that there has been little protection of private wealth throughout Chinese dynasties.

The modern world is completely different. Few countries these days can deny the role of the market. While China’s political system does not tolerate business owners like Musk being deeply involved in political lobbying or maneuvering, finding the right balance between the state and the market is tricky. If the state gets “bossy” by advancing state sector interests over private businesses, entrepreneurs will produce less and invest less, and if the state becomes a bully by labelling the rich as morally questionable, the frightened rich may just flee the country.