Advertisement

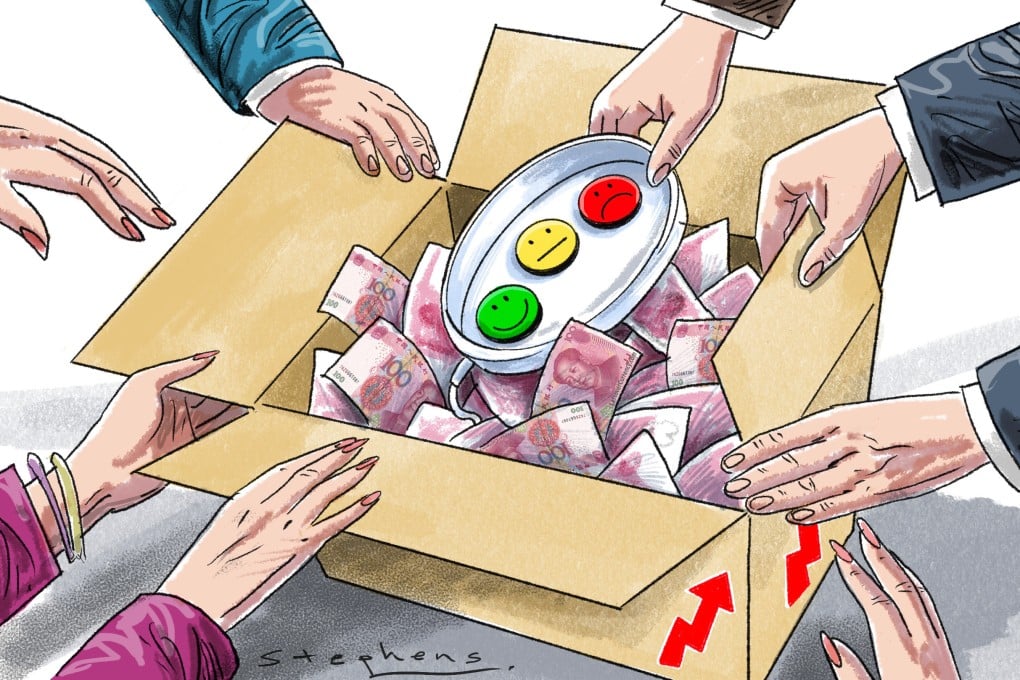

Opinion | China must now stimulate feel-good factor for economic recovery

China’s stimulus plan alone may not be enough, but Beijing has a track record of transforming expectations, which can translate into growth

Reading Time:3 minutes

Why you can trust SCMP

China’s economic stimulus package, announced on September 24, has been welcomed by markets, driving up share prices and shoring up housing markets on the mainland and in Hong Kong. This rise in asset prices has increased the value of household wealth, even if temporary, and the “wealth effect” may well boost consumption.

Advertisement

By the end of the month, the Shanghai A-share Index and Hang Seng Index had risen by 21.4 per cent and 15.8 per cent respectively. The average daily market turnover for the Shanghai and Hong Kong stock exchanges also increased by 158 per cent and 248 per cent compared to the pre-announcement period from September 3 to 23.

Clearly, China’s stimulus plan has had a positive impact on both stock markets. But the trading of existing assets, whether in shares or property, does not necessarily increase gross domestic product in any meaningful way, except for the commissions generated. It leads to a GDP increase only if it increases demand for new assets.

Thus, it remains to be seen whether these new levels of asset prices, and hence household wealth, are sustainable.

The Hong Kong and Shanghai stock markets have been on a sustained decline since mid-2020, in part because of the withdrawal of British and US institutional investors. There is some talk that the recent running up of share prices may provide them with a good exit opportunity.

Advertisement

The sustainability of these newly raised asset price levels is critical in determining whether the recovery of the markets is simply the result of a one-off irrational exuberance, or durable enough to turn public expectations around.

Advertisement