Advertisement

Opinion | What green light for Tesla says about China’s attitude to foreign investors

- From the Shanghai Gigafactory to Tesla’s autonomous driving plans, China’s encouragement reflects give-and-take and a recognition of the mutual benefits of foreign investment and tech

Reading Time:3 minutes

Why you can trust SCMP

4

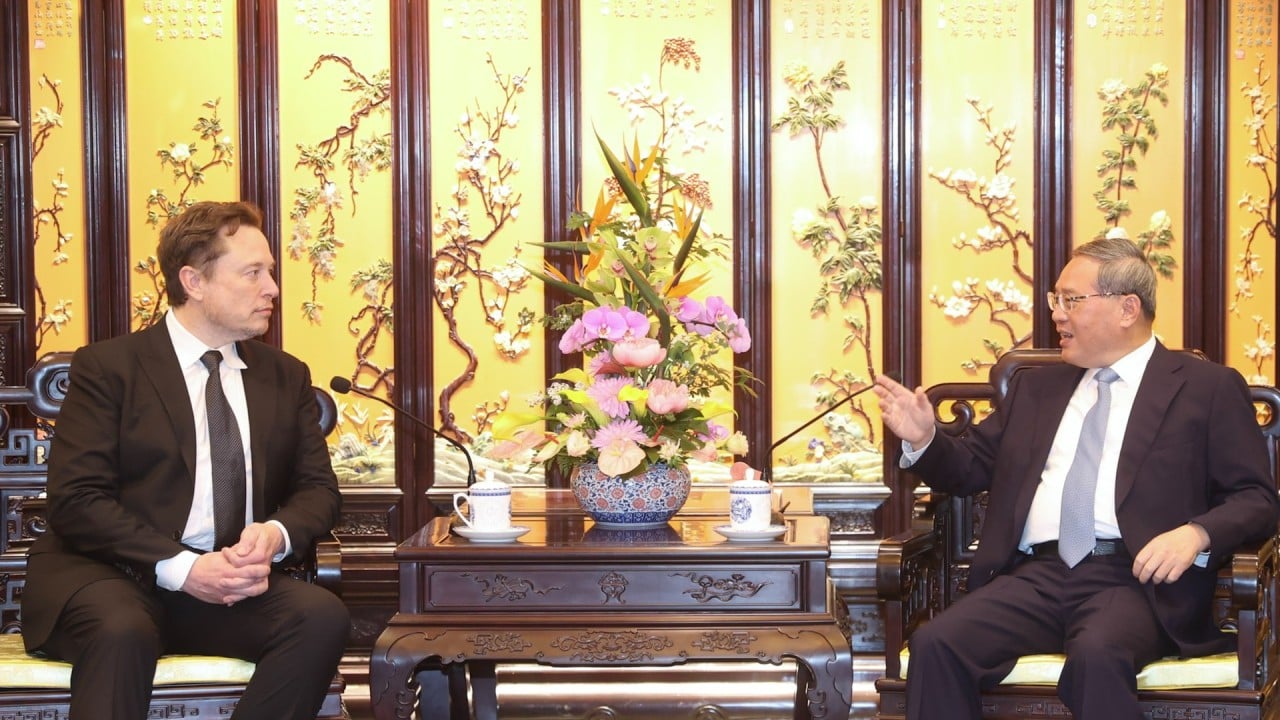

Soon after Tesla CEO Elon Musk met Chinese Premier Li Qiang in Beijing, news emerged of Tesla’s collaboration with Baidu to leverage the Chinese company’s mapping data and push the US carmaker’s Full Self-Driving (FSD) technology in China.

Advertisement

This collaboration is a significant move for Tesla amid intense competition from Chinese electric vehicle (EV) manufacturers. Musk has been seeking new strategies for the Chinese EV market – the world’s largest and arguably most innovative.

Six years ago, the US EV market was not growing as quickly as Tesla would have liked and the future seemed uncertain. News of Tesla’s difficulties hit its share price. Musk, who had been eyeing the Chinese market, visited Li, then Shanghai’s party secretary, in 2018, and negotiations led to Tesla’s Gigafactory in Shanghai.

The deal was a turnaround for Tesla. Its Shanghai factory has become the company’s largest production site, serving both the Chinese and export markets.

Why did Shanghai – and China – make the deal with Tesla and risk the US company posing strong competition to Chinese EV players? Isn’t China, as the Western narrative suggests, keen to protect its domestic companies from foreign competition?

Tesla’s Gigafactory started production in December 2019. By 2022, local companies were supplying 95 per cent of the parts needed – a plethora of EV part suppliers had grown up around Tesla, developing into an extensive ecosystem. Similar ecosystems have since come up across the country to service Chinese EV makers.

Advertisement