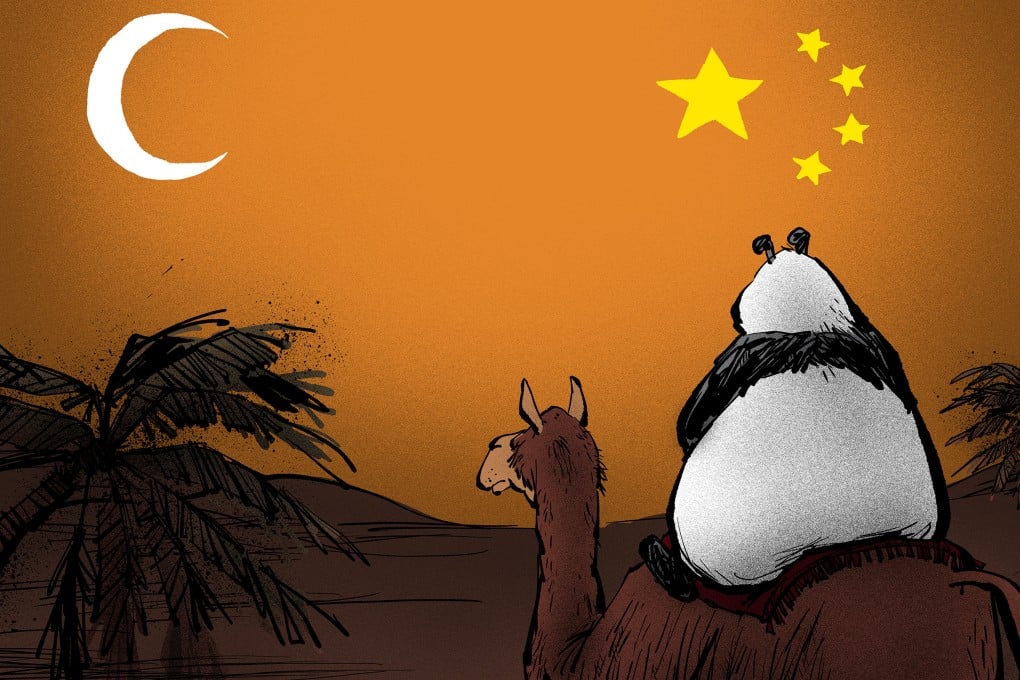

Opinion | China’s relations with the Middle East: gold mine or minefield ahead?

- While Sino-Arab economic ties have deepened, China is nowhere near replacing the US in the region

- Beijing is trying to balance its dependence on Middle East oil with increased arms sales to the region, a development that may prove significant

Flush with capital, investors throughout the Arab world are frantically investing in technology and infrastructure to replace oil as a locomotive of growth. China is among those swept up in the gold rush, jockeying for capital and access to markets as the world’s second-largest economy leverages its relations with Arab nations as a counterweight to the West.

Mergers and acquisitions are a major path for investment. The Middle East’s outbound M&A activity in China grew in 2023, with at least 16 deals worth US$8.5 billion, a significant increase compared to a single US$300 million deal in 2022, data from London Stock Exchange Group shows. This is the highest-ever annual total for Middle Eastern M&A activity in China since records began in the 1980s. In the other direction, Chinese companies also made more direct investment in Saudi Arabia in 2023 than ever before. All are foundations for the long haul ahead.

While the Sino-Arab investment flows are historic in scope, scale and pace, they still pale in comparison with those between the United States and the Middle East. In 2022, US foreign direct investment in the Middle East reached US$94.7 billion, while capital flows from the Middle East into the US totalled US$41.6 billion; manufacturing, mining, real estate and nonbank holding companies attracted the most capital.