23 arrested over fake loan requests for HK$31 million from Hong Kong Covid relief schemes

- Syndicates targeted government-back schemes offering low-interest loans to businesses and private individuals affected by Covid pandemic

Chief Inspector So Ka-fai of the Kowloon East regional crime unit said on Thursday that the police operation had prevented the loss of HK$26.9 million through the loan scams.

Those arrested included five alleged ringleaders and four core members in the two syndicates, he added.

The suspects comprise 16 men and seven women, who were all detained on suspicion of conspiracy to defraud – an offence punishable by up to 14 years in prison.

One of the syndicates started operating earlier this year, luring merchants and private individuals into applying for bank loans guaranteed for the government-backed initiative that focused on supporting businesses.

The Special 100% Loan Guarantee of the SME Financing Guarantee Scheme was launched in April 2020 and offered loans to help businesses struggling to pay employee wages and rents, in a bid to prevent closures and lay-offs.

The loans were fully guaranteed by the government at a concessionary low interest rate, with applications only closing in March of this year.

The maximum amount for each eligible enterprise was the total sum of employee wages and rent for 27 months or HK$9 million, depending on whichever figure was lower.

Senior Inspector Li Ka-wai of the same unit said the racket had operated through an online platform that posed as a one-stop shop for low-interest bank loan applications.

“The syndicate first arranged for individuals to become directors of shell companies and then created fraudulent bank documents,” he said.

The senior inspector said the same syndicate had also targeted company owners by offering help to secure the loans.

Police said it had rented two offices in Jordan and Wan Chai to offer consultation services.

“They charged the applicants a handling fee ranging from HK$20,000 to HK$90,000 each,” Li said.

He added that investigations showed the syndicate was behind four loan applications worth more than HK$30 million submitted to the same bank.

Police said the other syndicate was believed to be involved in 20 applications to the 100% Personal Loan Guarantee Scheme.

The initiative was rolled out in April 2021 and offered low-interest loans to residents suffering from the loss of their regular income during the pandemic. Applications for the scheme closed at the end of April of this year.

Senior Inspector Li said the group had contacted victims using cold calls that claimed to offer the loans, collecting the latter’s personal information to create fake bank documents for the applications.

“Each borrower was charged a handling fee ranging from HK$5,000 to HK$25,000,” he said.

Police said the 20 loan applications submitted by the syndicate between August 2021 and September 2022 had a combined value of HK$1.6 million.

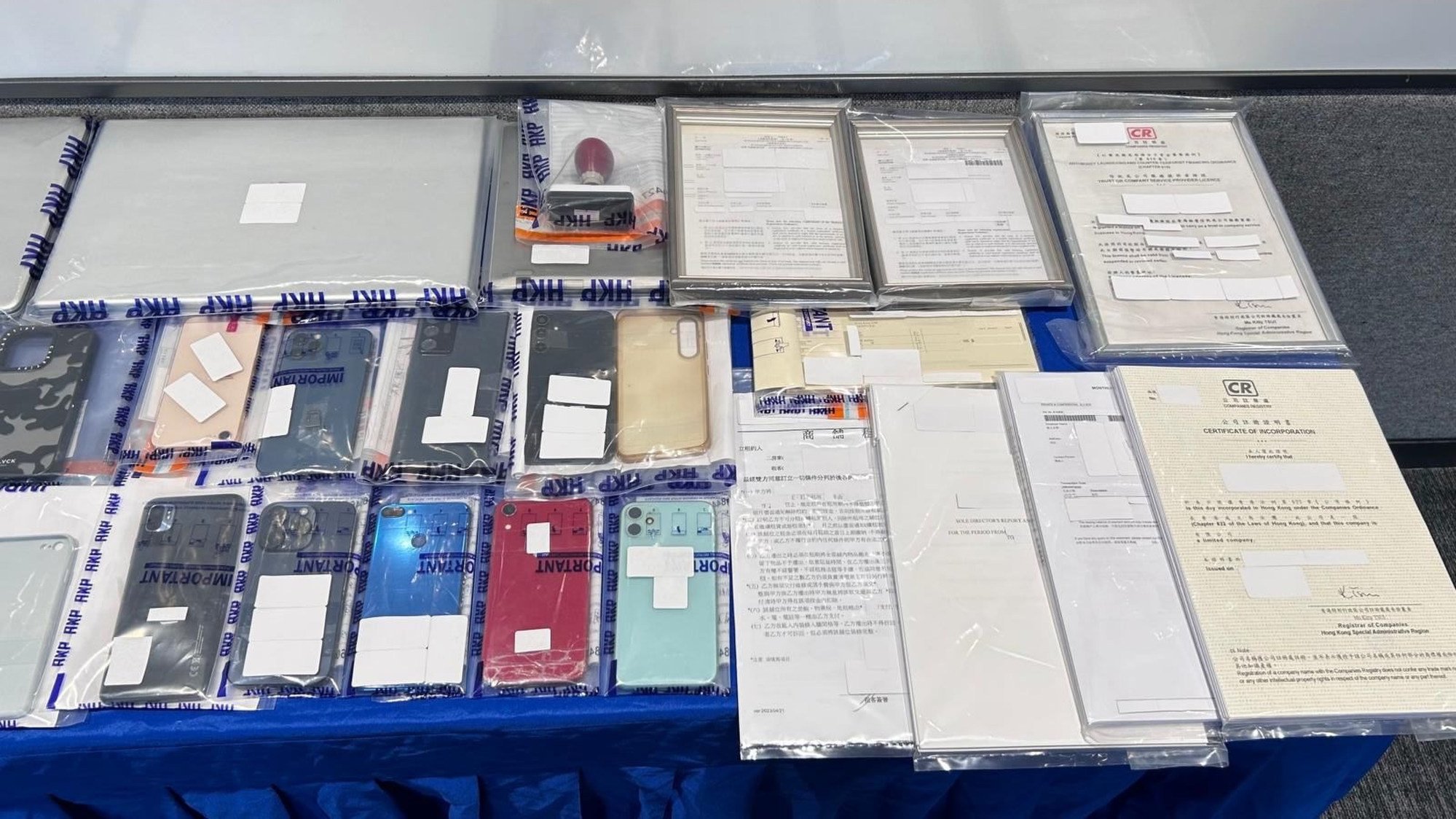

The force gathered evidence on both syndicates before arresting the suspects in a series of raids across the city between Monday and Wednesday.

Officers also seized bank documents and cards, electronic devices and cash during the arrest operation code-named “Tigerpath”.

Chief Inspector So reminded residents to be cautious when applying for any loans.

“If consultancy firms or intermediaries only require basic personal information and processing fees to grant loans with exceptionally favourable conditions, citizens should exercise extra caution,” he said.

“If these firms are involved in unlawful practices to help borrowers obtain loans, borrowers themselves may also face potential criminal liability.”

According to police, the 23 suspects have been released on bail pending further investigation.