‘Unfair’: property tycoon hits out at ‘Hong Kong is over’ criticism, says every market has its cycles

- Far East Consortium chairman David Chiu says stock market’s performance can’t be judged on recent lows

- Chiu calls on the government to devise strategies to lure overseas talent to maintain Hong Kong’s international character

A property tycoon has joined the fray to rebuff criticism that “Hong Kong is over”, arguing it is unfair to judge a stock market’s performance on recent lows and that housing transactions may surge 30 per cent in the year ahead.

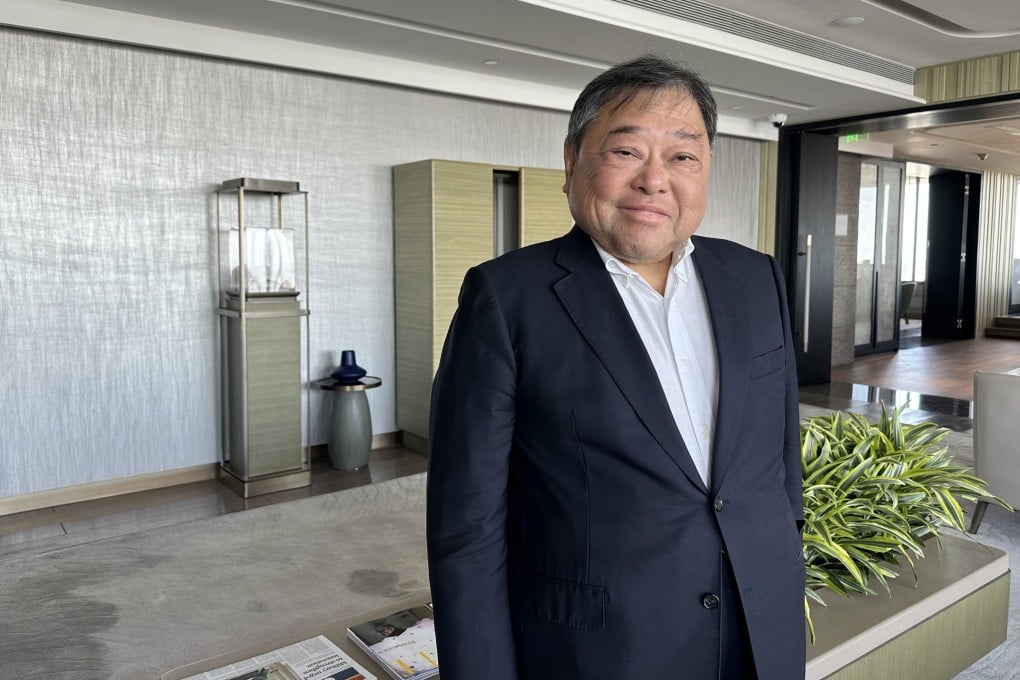

In an exclusive interview with the Post, Far East Consortium chairman David Chiu Tat-cheong, who sits on the standing committee of the country’s top political advisory body, urged the government to devise strategies to lure overseas talent to maintain the city’s international character, which he regarded as the key to future success.

The Hong Kong-born property tycoon, 68, rejected a pessimistic commentary by American economist and former Morgan Stanley Asia chairman Stephen Roach that sparked uproar.

In an article titled “It pains me to say Hong Kong is over” and published last month, Roach argued that the city’s stock market was likely to remain in the mire, citing domestic politics, Beijing’s structural economic problems and worsening US-China tensions.

Hong Kong’s benchmark index, which was in the 15,000-point range in July 1997 when the city returned to Chinese sovereignty, surged above 30,000 in 2007 and 2018. Last Friday, it closed at 16,353.

“Every market has its cycle. Hong Kong’s stock market had gone up to 30,000. But he just took today’s low point [for comparison],” Chiu said in Beijing as the Chinese People’s Political Consultative Conference (CPPCC) concluded its annual session.

“It’s an unfair statement.”