Update | China cuts interest rates in bid to halt stock turmoil and reassure markets after 'Black Monday'

Decision to also cut lending limits comes as Premier Li Keqiang says there was no basis for continued depreciation of the yuan

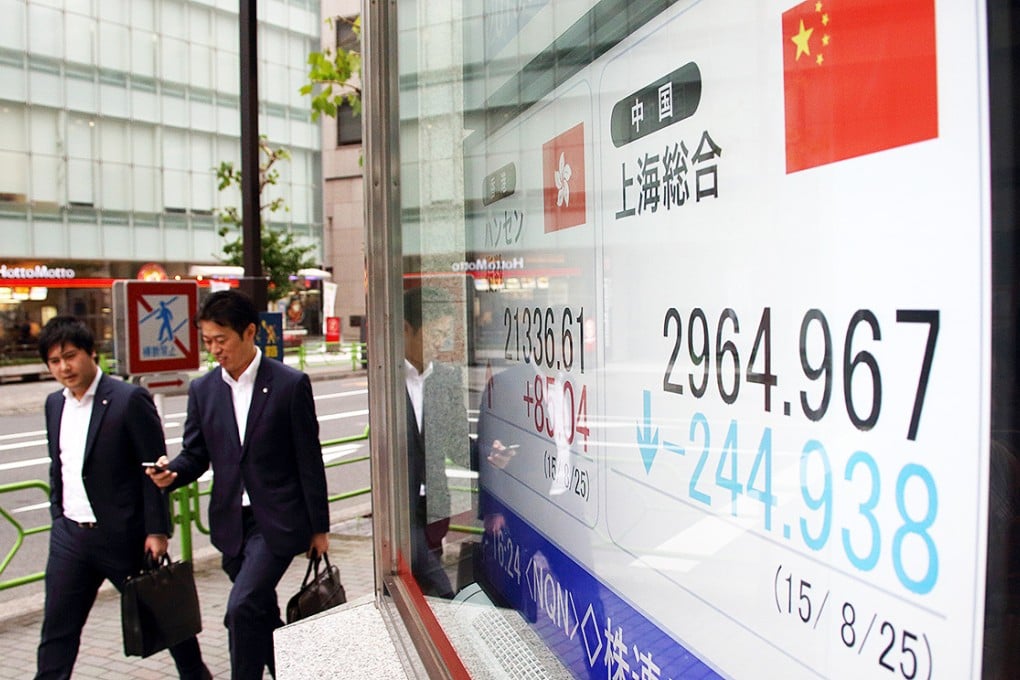

Beijing cut interest rates and eased bank lending limits yesterday in a bid to stop panic selling in mainland stock markets that smashed them to eight-month lows, even as equities elsewhere in the world began to recover from the previous day's rout which investors termed "China's Black Monday".

The move came as Premier Li Keqiang said there was no basis for continued depreciation of the yuan. He added that the yuan would "stay at a reasonable and balanced level".

China stock index futures traded in Singapore jumped nearly 6 per cent higher in response to twin moves that sliced 25 basis points from borrowing costs and cut the proportion of reserves lenders must hold on deposit with the central bank, injecting an estimated 650 billion yuan (HK$786 billion) of liquidity to help support the economy.

US stocks also rebounded last night as investors sought out bargains a day after Wall Street turned in its worst performance in four years.

Shortly after opening, the Dow Jones industrial average was up 374.74 points, or 2.36 per cent, at 16,246.09, with all 30 of its components in the black.

A global market meltdown on Monday was sparked by investor fears that China's fragile share markets were spiralling beyond the control of policymakers and would hurt economic growth. It triggered a flurry of international political rhetoric with US presidential hopefuls, European officials and others pointing fingers at Beijing and urging the government to act to stabilise the country's markets and economy.