The buying of Britain: Chinese biotech, insurance and tourism firms line up to make British acquisitions

Beijing see acquisitions as way for domestic businesses to update products and technology

Equipment makers, tourism agencies and insurers are joining China's mining, oil, and gas giants in investors in British business as mainland companies look to expand their horizons.

China's deal to take a one-third stake in French power giant EDF's £25 billion (HK$300 billion) next-generation nuclear project at Hinkley Point attracted all the big headlines.

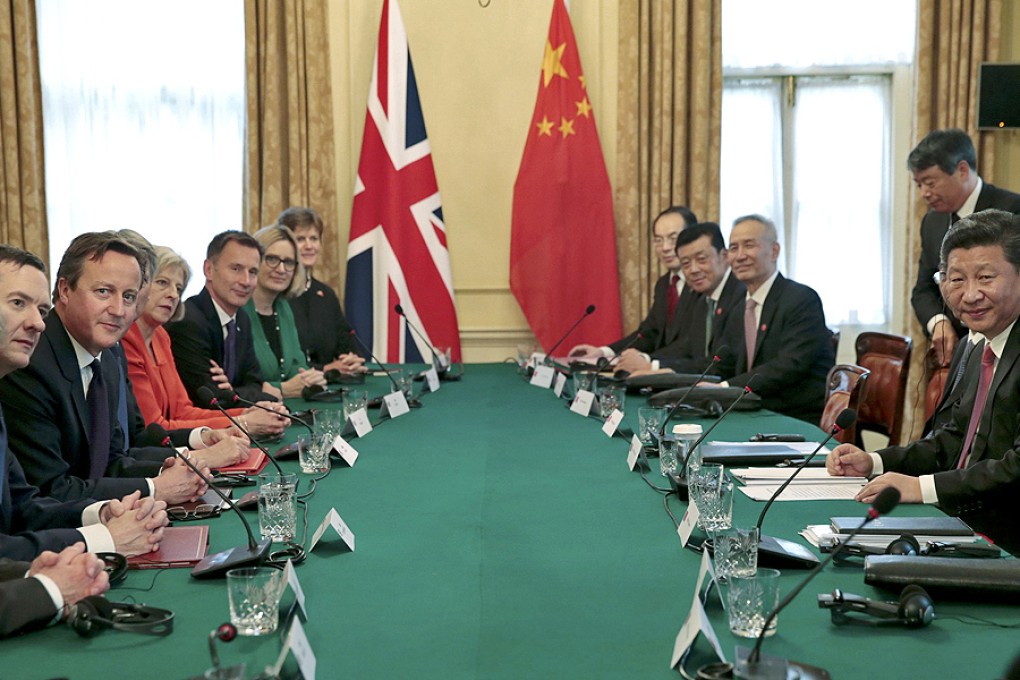

However, that was only one of many deals signed during last week's British state visit by President Xi Jinping , involving 150 projects worth about £40 billion (HK$595 billion), which emphasised the nations' strengthening business ties.

Before the global financial crisis Chinese firms focused largely on acquisitions in oil, gas and mining, yet since the start of the year firms have invested in more diverse industries including restaurants and hotels, transportation, real estate and technology, according to data from the financial services company Dealogic.

Ping An Insurance, China National Travel Service (HK) Group, Taikang Life Insurance, Wanfeng Auto Holding Group and CSR Group, the mainland train manufacturer, are some of the companies that have made British acquisitions this year.

Ping An bought Tower Place in London for £327 million in January, its second purchase in the city's financial district in less than two years. Then in April, CSR completed the £130 million buyout of the British submarine equipment maker. Specialist Machine Developments.

China National Travel bought Kew Green Hotels in August for more than £400 million.