US Senate weighing limits on US investments in Chinese hi-tech businesses

- Banking Committee holds hearing with some members seeing unfettered US business ties to Chinese firms as a loophole in export controls and a national security risk

- Separately, US Commerce Secretary Gina Raimondo says a new law requires any company taking federal subsidies to build chips in US not to transfer tech to China

Members of a US Senate committee said Thursday they are considering new rules to block investments in China’s hi-tech sectors, a move they said was needed to stop American money from financing Beijing’s tenacious efforts to out-compete Washington, even as they differed on what form the rules should take.

“We know that our adversaries will use any means they can to close the gaps between our technological capabilities and theirs, without much care to how legal their tactics actually are,” Sherrod Brown, the Ohio Democrat who is chair of the Senate Banking Committee, said.

“What we don’t know is to what degree US investments are helping them close those gaps.”

The committee hearing was the latest sign of a growing sense of alarm throughout the US government about whether deep business and economic ties with China – built up over the last two decades – have ultimately harmed US national security.

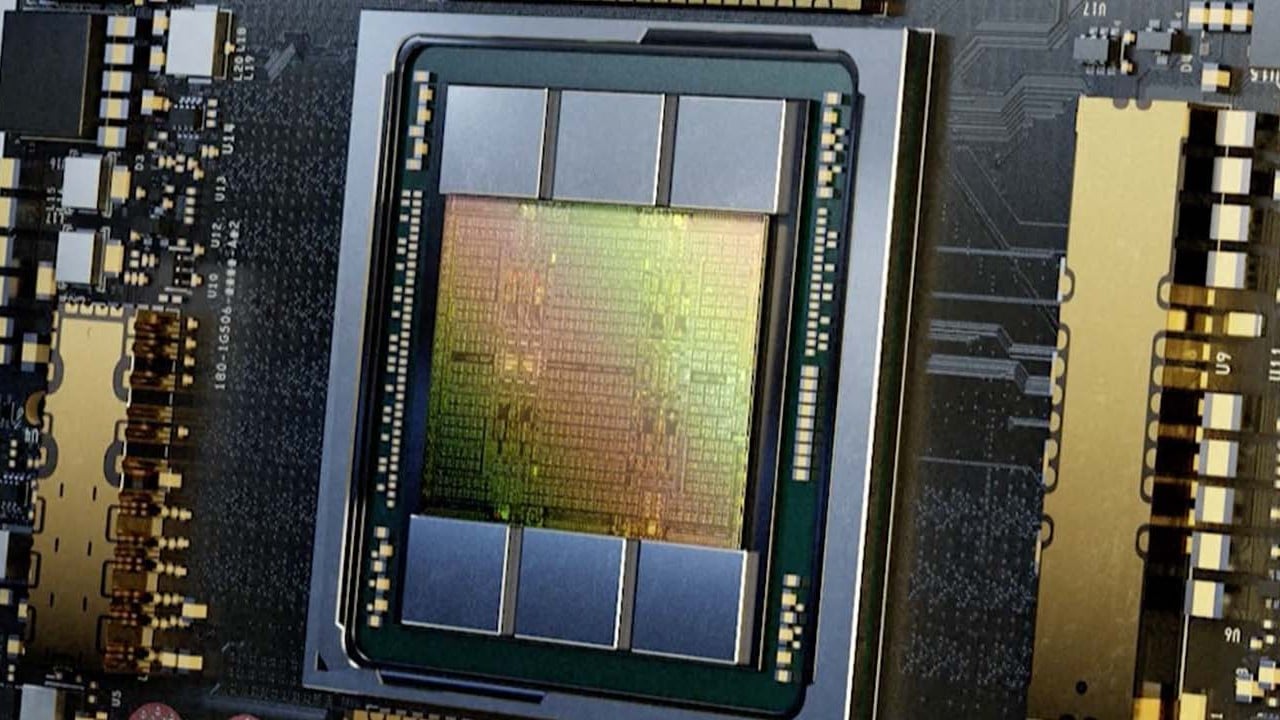

Senators on the committee said that investments in Chinese hi-tech companies – still legal despite a slew of US actions targeting many sectors in China – should be viewed as a dangerous loophole in Washington’s export controls.

We’re seeing the vulnerabilities of an open door between our economies

In particular, they questioned whether a Chinese company that was already prohibited from receiving US equipment should still be allowed to receive US money. Researchers have estimated that about US$118 billion in American capital is invested in China.