China's US$40-billion Silk Road Fund will be driven by profit, says its chief

Chief of US$40b infrastructure investment project says it will prioritise shareholders' interests while boosting China's clout abroad

The Silk Road Fund will invest in projects that guarantee returns, its chairman said on Thursday amid concerns that it would be hard for the fund to yield profit because of high geopolitical and commercial uncertainties.

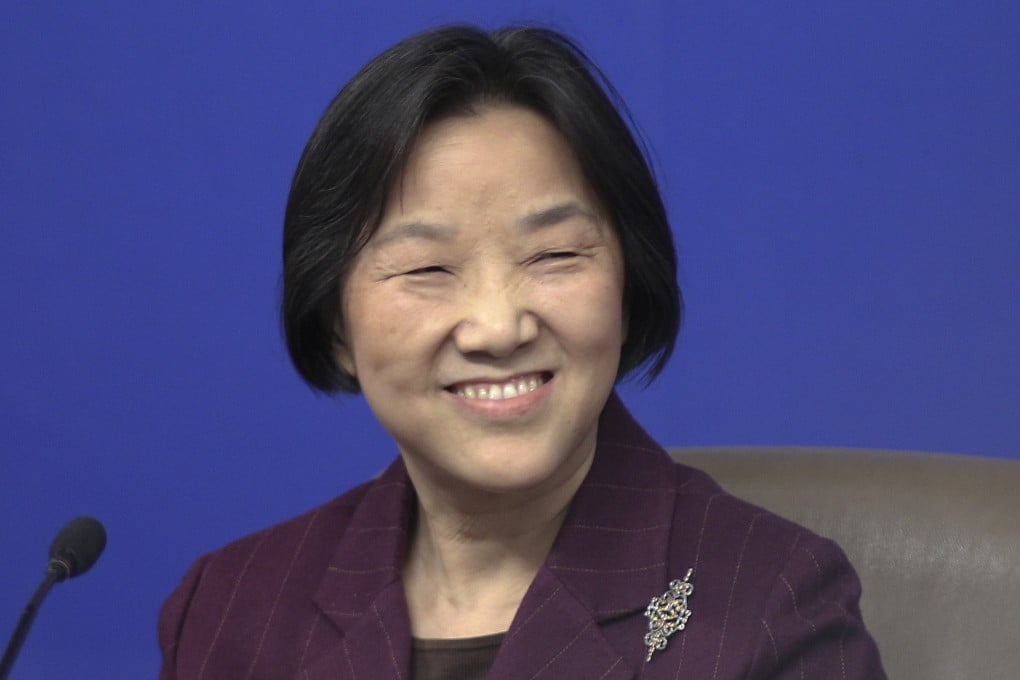

Jin Qi said market-oriented principles would apply in the operation of the US$40 billion (HK$310 billion) fund and shareholders' interests would be considered when making investment decisions.

"The fund is not an aid agency," she said on the sidelines of the National People's Congress. "We will seek reasonable mid- and long-term investment returns and protect the rights of the shareholders."

Beijing last month launched the fund to boost infrastructure and businesses in countries stretching through Asia to Europe. Contributions will come from China's foreign exchange reserves, the China Investment Corporation, the Export-Import Bank of China and the China Development Bank.

For all the latest news from China’s parliamentary sessions click here

Critics have compared the scheme to the Marshall Plan - the economic support the US gave to Europe to help it rebuild after the second world war, and question if the fund is sustainable given the high political and economic risks in regions along the route.