Indian court summons ‘served’ to billionaire through Malaysian media

Two-page court order was published in Malaysian newspapers

By Cindy Yeap

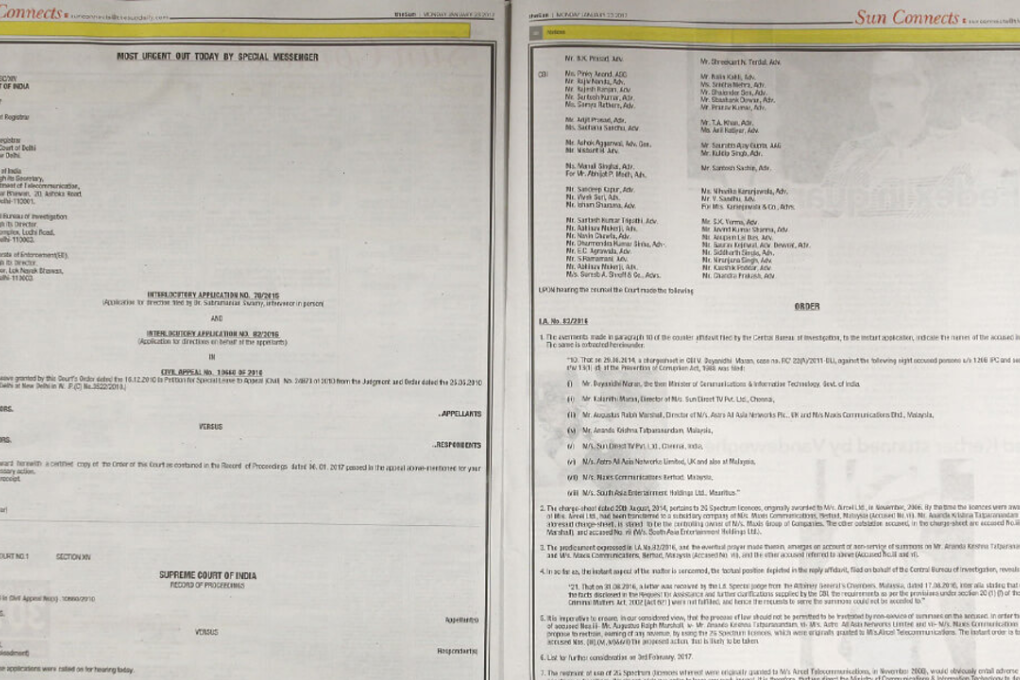

Billionaire Ananda Krishnan and his long-time point man Ralph Marshall’s run-in with Indian authorities reached a new epoch with the publishing of a two-page court order by the Supreme Court of India in Malaysian newspapers summoning the duo to appear before it or risk financial consequences.

Those familiar with the run-in say the court order does not concern Bursa Malaysia-listed Maxis Bhd and Astro Malaysia Holdings Bhd (which only has Malaysia operations and not Indian units that are held by separate entities controlled by Ananda), but essentially frustrates a planned merger between Ananda-controlled Indian wireless telecoms operator Aircel Ltd and larger rival Reliance Communications Ltd, owned by India’s 32nd richest billionaire Anil Ambani (US$2.5 billion [RM11.1 billion] net worth according to Forbes).

“In order to enforce the presence of [the] accused Augustus Ralph Marshall, Ananda Krishnan Tatparanandam, Astro All Asia Networks Ltd and Maxis Communications Bhd, we propose to restrain, earnings of any revenue, by using the [Aircel’s] 2G spectrum licences, which were originally granted to Aircel Telecommunications,” read the Jan 6 Indian court order, carried over two pages in The Sun newspaper yesterday.

“It is imperative to ensure, in our considered view, that the process of law should not be frustrated by non-service of summons on the accused. The instant order is to bring to the notice of the accused … the proposed action that is likely to be taken. It would be open for the accused to enter appearance before this Court and make their representation in consonance with law, failing which … the proposed order shall be passed [and] will not be open to any of the accused to raise an objection with reference to any monetary loss emerging out of the proposed order,” read the court order, which also stays the selling and trading of Aircel’s 2G spectrum.

Bursa-listed Maxis Bhd and Astro Malaysia Holdings — both relisted with only Malaysian mobile and pay-TV operations respectively — have previously said that actions by India’s Central Bureau of Investigations (CBI) against their largest shareholder neither implicates them nor affects their operations.