Amazon, Netflix, Uber and Tesla were all backed by Softbank founder Masayoshi Son, but is the Japanese billionaire falling on harder times since the pandemic and WeWork’s failed IPO?

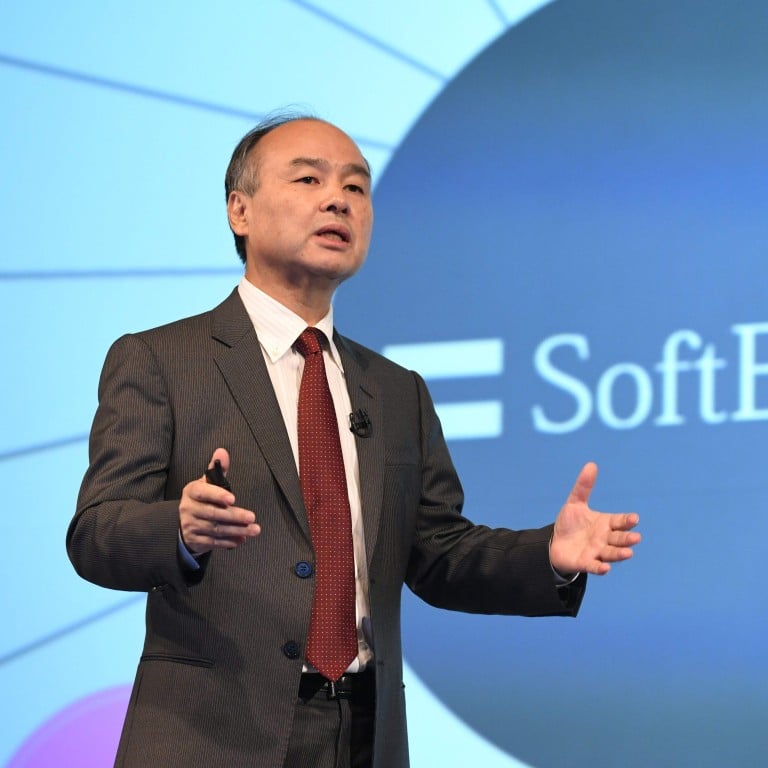

The numbers and rapid changes of fortune are dizzying, but par for the course for SoftBank CEO Masayoshi Son, whose upbringing as the son of Korean immigrants couldn’t be further from his current life – but is he worried after SoftBank’s market value suddenly dropped by US$10 billion this month?

SoftBank’s market value dropped by US$10 billion this week after The Wall Street Journal reported that the company has been placing huge bets on risky tech investments.

And while SoftBank’s founder and CEO Masayoshi Son is the third-richest person in Japan with a US$20.6 billion personal fortune and millions of dollars of real estate in Tokyo and Silicon Valley, this must have hurt.

Through SoftBank and his first US$100 billion Vision Fund, Son has invested millions in some of Silicon Valley’s biggest tech companies in recent years, including Uber, Slack, Amazon, Tesla and Netflix.

But Softbank was also the biggest investor in WeWork, losing more than US$4.7 billion after the co-working company’s failed IPO.

Most of Son’s wealth comes from his 27 per cent stake in Softbank, which makes him the largest shareholder, according to Bloomberg. However in recent months, SoftBank has been suffering – not least because of the coronavirus pandemic. In April, SoftBank announced that its Vision Fund would suffer a whopping US$17 billion annual operating loss.

So just who is this incredibly wealthy individual with the fate of the world’s biggest companies in his hands – and is it actually the other way around?

He had humble beginnings

Son was born in 1957 to Korean immigrants on the Japanese island of Kyushu. The 63-year-old CEO was one of four brothers, and his father worked at a number of restaurants, farms and fisheries.