Why jewellery remains a shining investment during troubled times – in the year Drake paid US$1 million for Tupac Shakur’s crown ring

- Jewellery came second only to art in The Knight Frank Luxury Investment Index, which unusually dipped slightly into negative territory in 2023

- Period pieces, coloured gemstones and single-owner collections are the strongest subsectors, with Tupac Shakur’s crown ring achieving 3 times its estimate at a Sotheby’s auction

According to the latest Knight Frank Luxury Investment Index (KFLII), jewellery stood out as the second-highest-performing asset class for the year, recording annual growth of 8 per cent and only trailing art.

“This makes it a great investment during periods of economic uncertainty,” said Andrew Shirley, partner, and head of rural and luxury research at Knight Frank.

The KFLII, which tracks price movements across 10 key asset classes, dipped slightly into negative territory for only the second time ever as the luxury market cooled from record highs.

“Not all categories of the jewellery market are under pressure,” said Jonathan Abram, brand director at jewellery house Ronald Abram.

“The collectable rare jewels we specialise in have consistently held their value.”

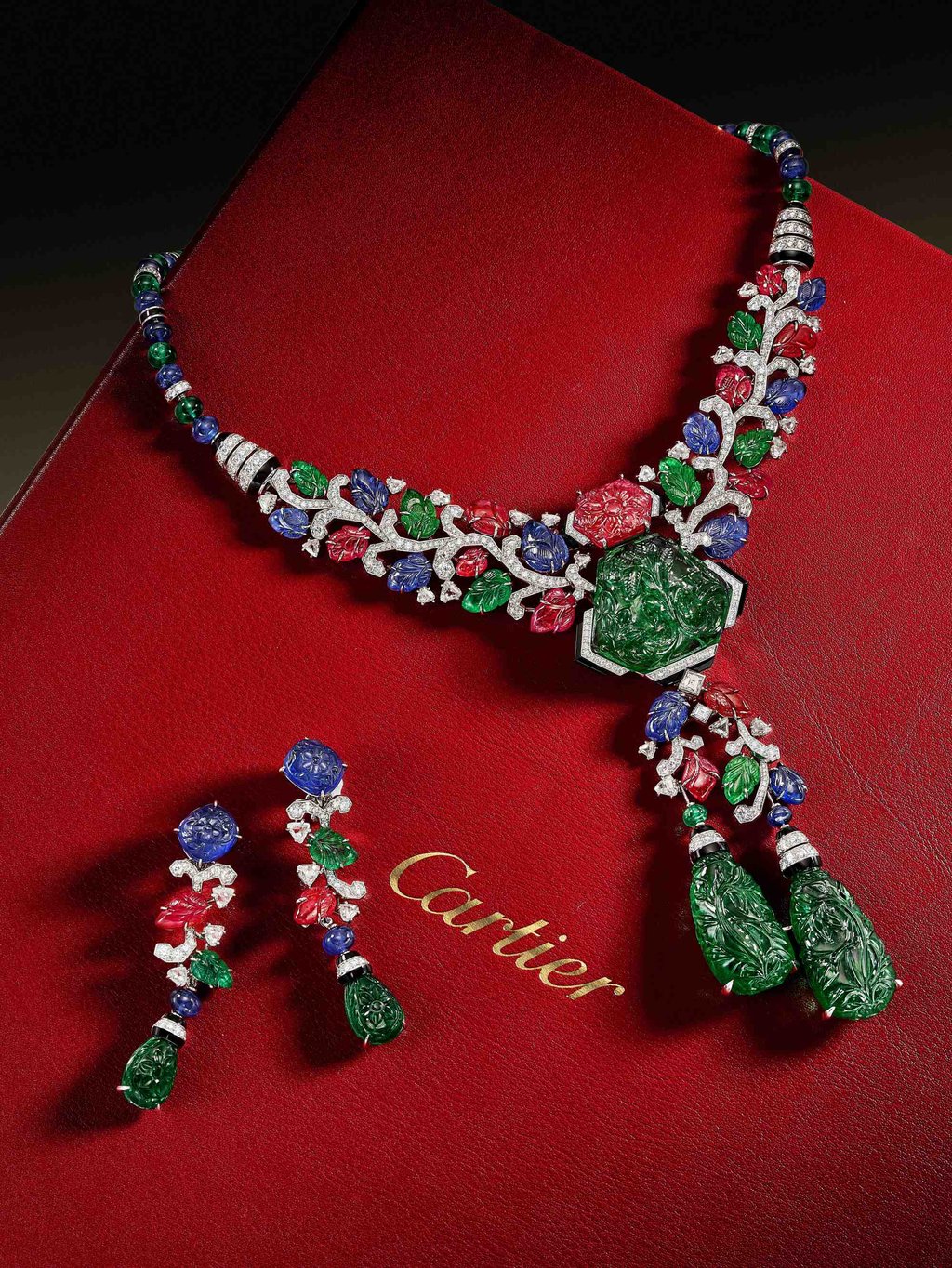

Collectors are gravitating towards natural-coloured untreated gemstones, such as Burmese rubies, Kashmir sapphires and Colombian emeralds, according to Abram. There is also growing interest in estate jewellery, particularly signed pieces from well-known international jewellers.