Is jewellery still a smart investment? The spring auction season says so – Sotheby’s Hong Kong Magnificent Jewels set a record for diamond sales, and Phillips’ numbers are up, too

- Benoît Repellin and Louisa Chan of Phillips in Hong Kong reported a 20 per cent rise in takings, while Poly Auction and China Guardian also reported healthy results from the spring auctions

- Bonhams’ and Christie’s have sales in May, both featuring important pieces from Cartier including a rare India Tutti Frutti Necklace, and Love and Panthère rarities

So far in 2024, so good for the resilience of the upper echelon of Hong Kong’s jewellery market, with premium lots selling at robust prices at recent spring auctions.

Exceptional pieces invariably attract discerning connoisseurs, both locally and overseas. The current robust demand underscores the globally recognised investment value of top-quality jewellery.

At Sotheby’s Hong Kong’s Magnificent Jewels sale last month, a record was set for a natural fancy-coloured diamond sold at auction, with an extremely rare 7.01-carat fancy vivid yellowish orange diamond achieving HK$4.2 million (US$540,000) per carat. This represents a significant 64.2 per cent increase over the previous record of HK$2.5 million per carat paid for a fancy vivid yellowish orange diamond sold in 2023. This record-breaking diamond, cut in a classic cushion style and of VS2 clarity, fetched HK$29.49 million. Sotheby’s experts described it as “boasting an unrivalled hue and saturation”.

However, the top lot at this auction was a colourless diamond. The Fortune Five, an oval brilliant-cut gem weighing 55.55 carats, was sold for HK$45.2 million. This D flawless diamond, with excellent polish and symmetry, is also certified as Type IIa, a category reserved for diamonds of the highest chemical purity that often exhibit exceptional transparency.

Among the rarest and most coveted coloured gemstones are unheated blue sapphires of certified Kashmiri origin. This Sotheby’s auction featured a fine example: a cushion-shaped stone weighing 16.65 carats. Accompanied by a report from SSEF, the stone is described as having “an attractively saturated blue colour and very fine purity”. Set in a Harry Winston ring with a maker’s mark of Jacques Timey, this prized item sold for HK$19.81 million, achieving the third-highest price at the auction.

Equally desirable are unheated Burmese rubies in pigeon blood red. A ring featuring a 5.07-carat cushion-shaped ruby of this highly prized colour with certified Burmese origin fetched HK$12.67 million at the auction.

Elsewhere, Phillips reported a 20 per cent increase in the total take at the house’s spring Hong Kong auction, hosted in March, compared with the previous season – underscoring the resilience of global demand for rare and important jewellery pieces.

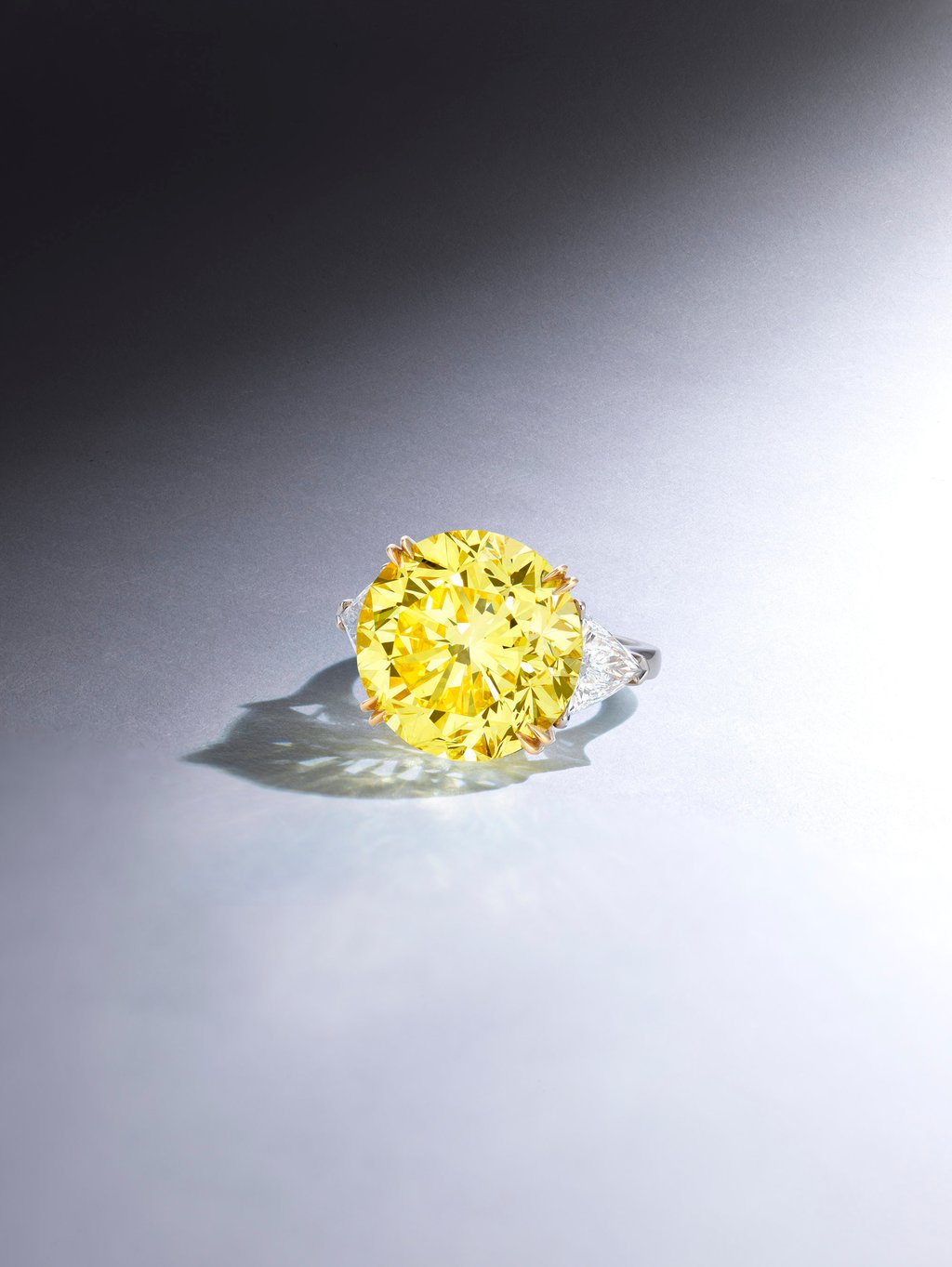

The star lot at Phillips’ auction was a 15.51-carat round brilliant-cut fancy vivid yellow diamond, set in a ring alongside smaller diamonds. It led the auction, fetching HK$8.9 million. The second highest-priced lot was a necklace adorned with turquoise and diamonds by Van Cleef & Arpels, circa 1985. It realised HK$4.57 million, a pleasant surprise given its estimate was between HK$900,000 and HK$1.2 million.

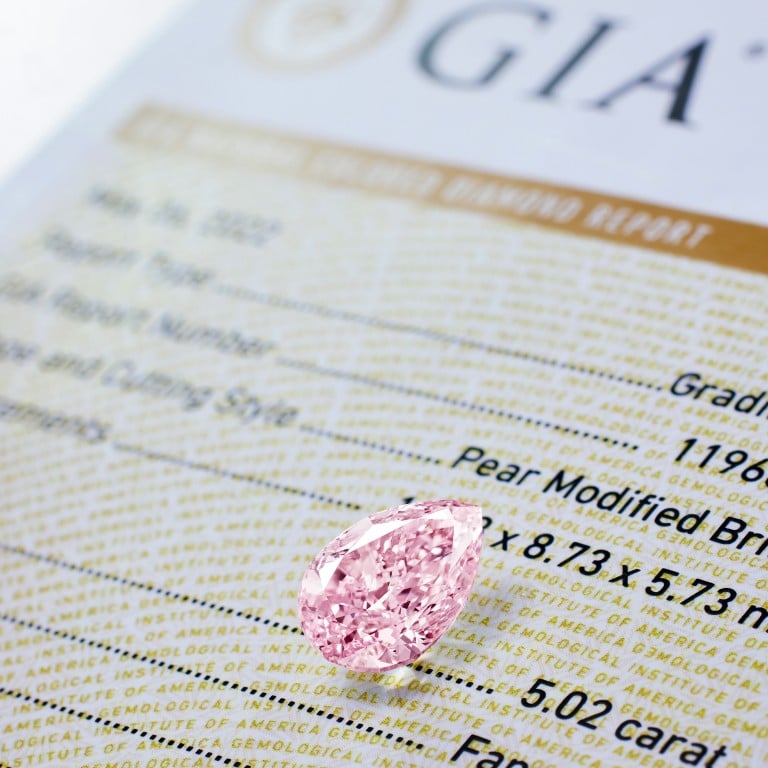

At Poly Auction Hong Kong’s spring sale, diamonds and gemstones in vibrant colours captivated bidders. The top lot was a 5.02-carat fancy pink diamond in pear shape, which sold for HK$13.2 million. It was followed by a ring crowned with a spectacular 11.4-carat Mozambique ruby in oval shape, accented with diamonds, which fetched HK$5.64 million. Another highly prized lot was a jadeite cabochon of exceptional colour and translucency set in a ring with diamonds that fetched HK$4.56 million.