Pfizer: what’s next for the Covid-19 vaccine maker and its US$28 billion war chest?

- Pfizer’s vaccine saw it become the world’s most visible pharmaceutical company, but with its stock falling in 2022, investors are impatient for an encore

Pfizer emerged from the Covid-19 pandemic as the world’s most visible drug maker, but its success has left investors impatient for an encore.

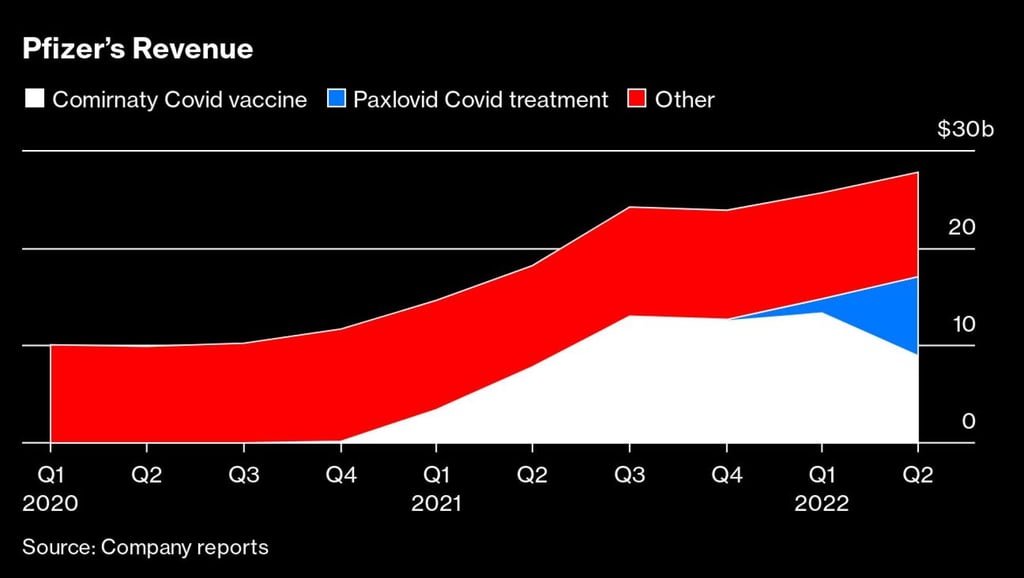

The windfall from the pharmaceutical giant’s Covid-19 vaccine almost doubled its revenue in just one year. And now the shot, coupled with Pfizer’s Covid antiviral pill, is poised to make up more than half of its expected US$100 billion of sales in 2022.

That’s left Pfizer flush with cash – US$28 billion it could spend on the kinds of deals that fuelled its growth into an American colossus.

The pressure is clearly on for Pfizer to show that the muscle it built during the pandemic won’t atrophy. Big Pharma companies don’t normally double revenue so quickly, and nobody expects that kind of growth to continue.

But one thing is clear: Pfizer can’t go back to the sluggish path it was on for years. Its stock has already fallen 25 per cent in 2022 on fears that might happen, trailing the market and other drug makers.

“Pfizer was boring before Covid,” says BMO Capital Markets analyst Evan David Seigerman. “They’re being penalised because either investors don’t see a future for Covid or they don’t have visibility into that future.”