How NFTs, online bidding and Asian demand helped auction houses to a bumper 2021, with Sotheby’s and Christie’s selling US$14.4 billion alone

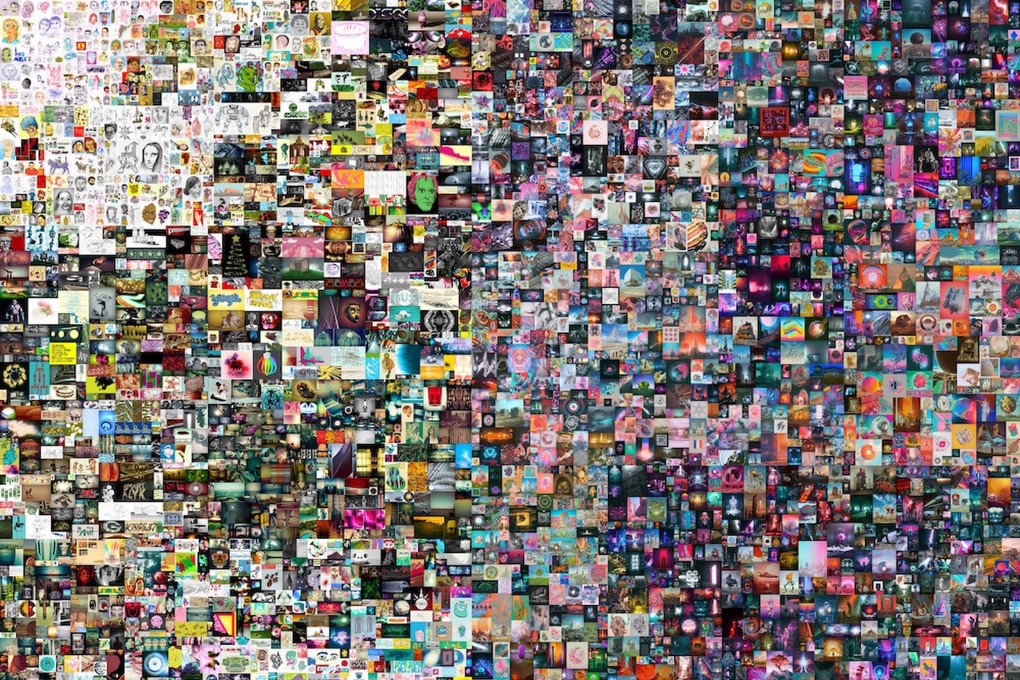

- Incredible moments include the US$69 million sale of Beeple’s NFT Everydays – The First 5,000 Days and the US$25 million sale of Banksy’s Love is in the Bin

- Nearly half of bids made for Sotheby’s pieces over US$5 million came from Asia, while Asian spend accounted for a third of all auction sales at Christie’s

The global pandemic is dragging on and 2021 is ending with a new, highly transmissible mutant strain. Yet auction houses this week reported a bumper year that was boosted by Asian demand, a surge in online bidding and a new acronym that has dominated art market news this year: NFT.

The two biggest auction houses in the world sold a total of US$14.4 billion of art, watches, jewellery, wine and other collectibles in 2021, 53 per cent more than their combined sales in 2020.

Sotheby’s retained its number-one spot with record turnover for the auction house of US$7.3 billion, while Christie’s followed closely with US$7.1 billion, its best in five years.

The third largest player looks set to be China’s Poly Culture Group, which has yet to report its final figures but has seen its Hong Kong and mainland Chinese auctions turnover increase by 40 per cent to US$1.6 billion this year. That figure includes the US$176 million from two sales it co-hosted in Hong Kong with Phillips, which has been aggressively growing its art and design sales and clocked up a company high of US$1.2 billion in sales this year (which also includes the results of the joint sales with Poly in Hong Kong).

Christie’s calculates that Asian buyers contributed a total of US$1.7 billion to its sales this year, up 32 per cent from 2019, with Asian spend accounting for around a third of all auction (excluding private) sales.