China’s stock market could enjoy ‘instant’ boost from 2 trillion yuan fund: think tank

Institute of Finance and Banking under the Chinese Academy of Social Sciences says the fund would enhance the stability of the capital market and promote steady growth

China should issue 2 trillion yuan (US$280 billion) in special bonds to establish a stock market stabilisation fund, a government-affiliated research institute proposed on Tuesday, amid broader efforts by authorities to bolster the economy.

The fund would help enhance the inherent stability of the capital market and promote steady economic growth, according to the report by the Institute of Finance and Banking under the Chinese Academy of Social Sciences.

The call for purchasing blue-chip stocks and exchange-traded funds came as the stock market has become a key gauge of market sentiment and also a tool to restore confidence, especially for more than 200 million retail investors in the A-share market.

“The stock market responds more quickly to policy benefits, making it easier to attract incremental funds from household savings, bank wealth management, and foreign capital, thereby boosting market confidence almost instantly,” the Beijing-based governmental think tank said.

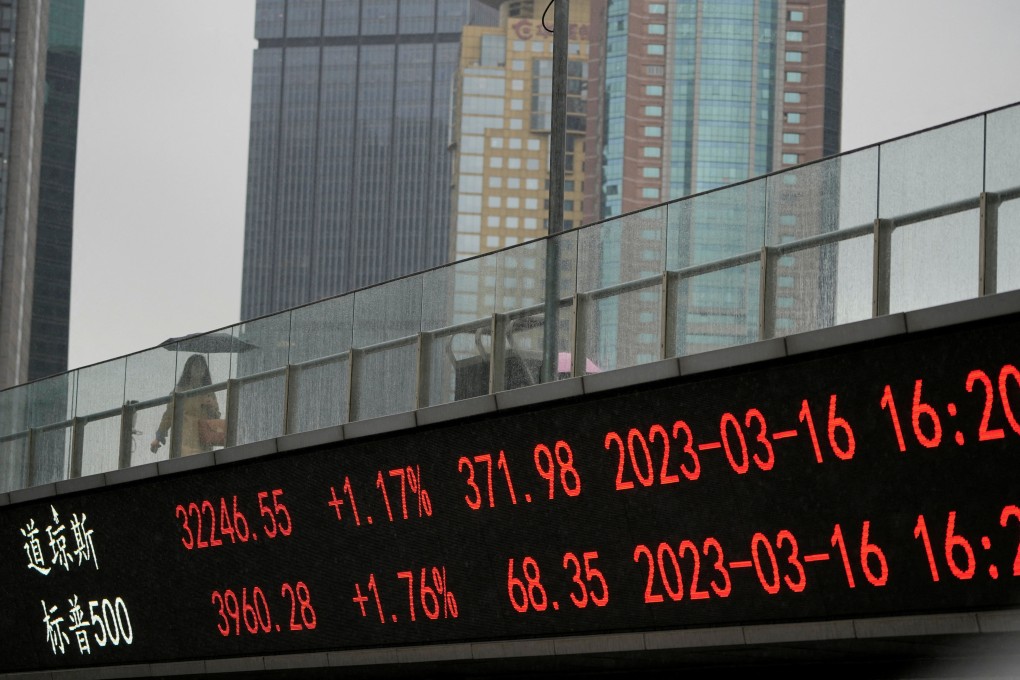

However, there have been wild swings in China’s stock market in the past month, amid concerted efforts by the government to revitalise the economy through a broad range of stimulus policies.