Advertisement

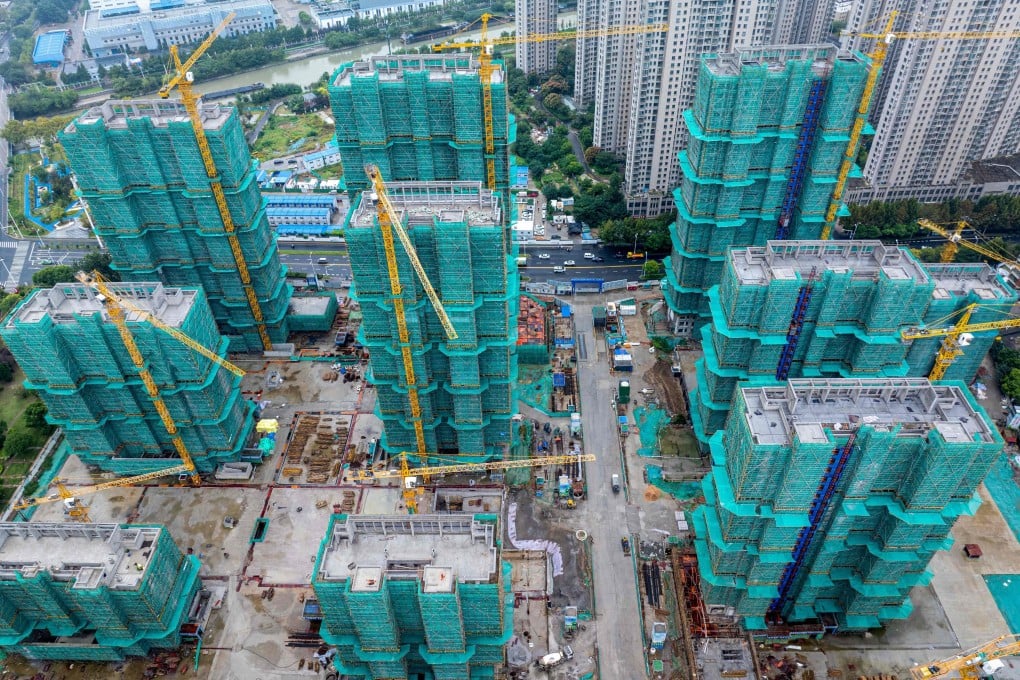

China cuts mortgage rate in ‘encouraging sign’, but heavy lifting still needed

Five-year loan prime rate lowered from 3.85 per cent to 3.6 per cent, the People’s Bank of China said on Monday

Reading Time:3 minutes

Why you can trust SCMP

13

China slashed a key reference rate for mortgage loans on Monday amid further efforts to stabilise the property market, but while the move was welcomed as part of a broader push to jolt the economy, analysts continued to call for an additional fiscal response.

Advertisement

The five-year loan prime rate (LPR), which commercial banks use as a benchmark for their mortgage rates, was lowered from 3.85 per cent to 3.6 per cent, according to the People’s Bank of China.

The one-year loan prime rate, the reference rate for corporate loans, was also cut by a quarter of a percentage point from 3.35 per cent to 3.1 per cent.

The announcement came as a “small dovish surprise” since the cuts aligned with the upper end of the range mentioned by central bank governor Pan Gongsheng last week, according to a report by Goldman Sachs.

“This reflects the PBOC’s continued efforts to lower financing costs for the real economy,” the report said.

Advertisement

The third cut to the LPR this year, after rates were last cut in July, followed Pan’s announcement at a financial forum on Friday that lending rates would decrease by between 20 to 25 basis points.

Advertisement