China eyes sci-tech venture capital to boost industrial upgrade, economic growth

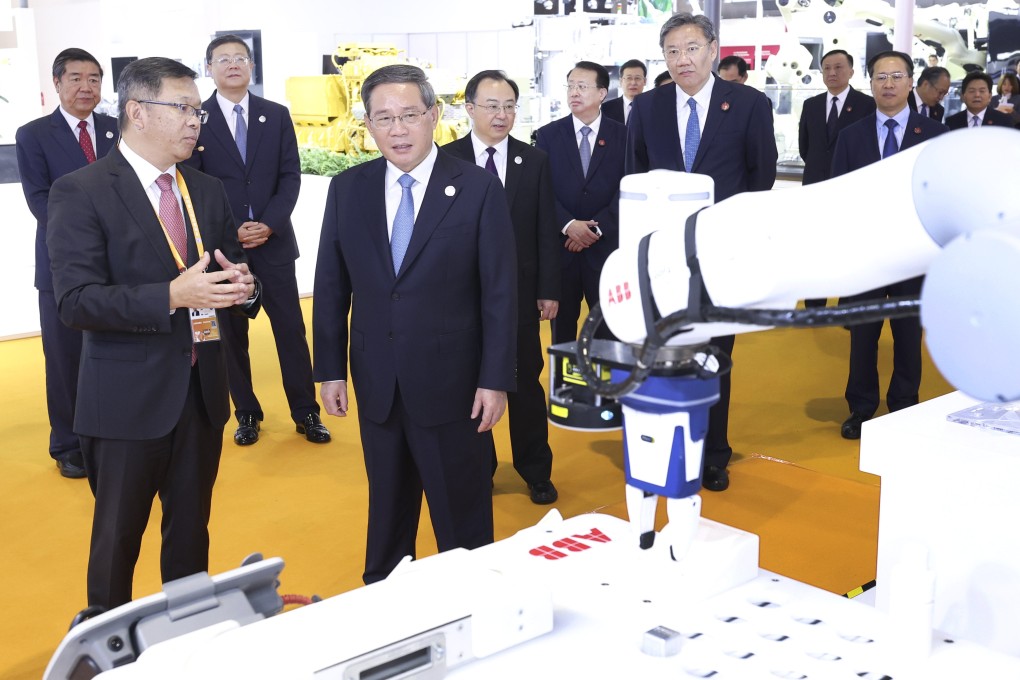

Premier Li Qiang said on Wednesday the development of venture capital is critical to sci-tech innovation, industrial upgrading and the growth of the economy

Beijing has called for measures to boost the development of venture capital and stressed the need for so-called patient capital to support the growth of science and technology companies, as China’s vision of achieving technological strength still faces challenges in its capital market activities.

Premier Li Qiang told a State Council executive meeting on Wednesday that Beijing would further facilitate fundraising, investment and management, as well as mechanisms for venture capital firms to withdraw their capital, while also supporting the listing of qualified science and technology companies in the domestic and overseas stock markets.

“The development of venture capital is critical to sci-tech innovation, industrial upgrading and the high-quality growth of the economy,” Li said, according to a State Council statement.

Venture capital is a form of private equity and a type of financing for start-up companies and small businesses with long-term growth potential.

China’s cabinet also pledged to vigorously develop the equity transfer and mergers and acquisitions (M&A) market, further advance the pilot programme for distribution-in-kind shares and encourage social capital to establish market-based M&A master funds or venture capital secondary market funds.

A distribution-in-kind, also referred to as a distribution-in-specie, is a payment made in the form of securities or other property rather than in cash.

The pilot model for distribution-in-kind shares aims to reduce volatility in the secondary market by allowing investors to retain their shares after exiting the fund, rather than being required to sell their assets on the secondary market to receive cash.