Trump’s proposed China import tariffs would hit average Americans like a US$1,700 ‘tax increase’, researchers find

- Impact of across-the-board trade actions would have ‘significant collateral damage on the US economy’, Washington-based organisation says

- Findings reflect how Washington’s hardline trade tariffs get ‘fully passed through to American buyers’

A vow by Donald Trump to raise import tariffs – including a 60 per cent levy on Chinese shipments – if he is re-elected US president would effectively raise taxes on middle-class and poorer Americans, a Washington-based research organisation has found.

The higher rate for China, plus a 10 per cent “across-the-board” import tariff that Trump has proposed, would cut after-tax incomes by 3.5 per cent in the bottom half of the US “income distribution”, the Peterson Institute for International Economics (PIIE) said in a policy brief released this week.

His measures would cost a “typical household” at the centre of that distribution about US$1,700 per year, the brief added.

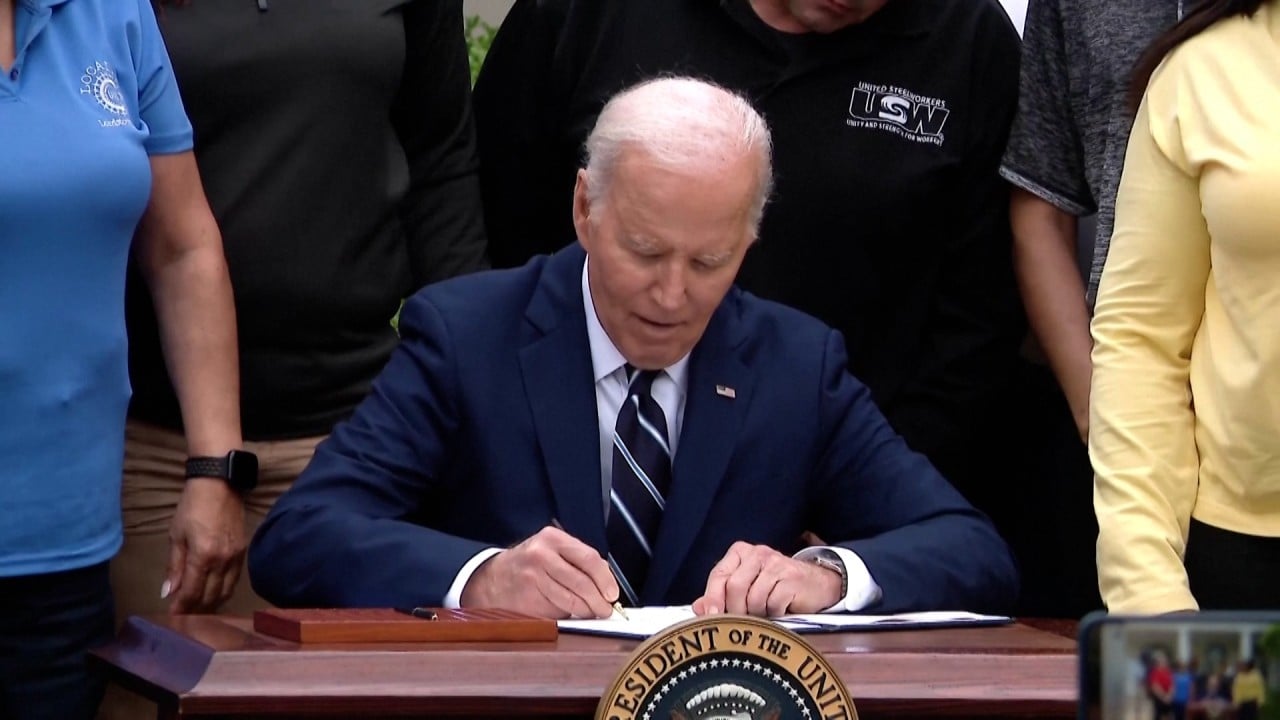

The PIIE report noted how the Biden administration has opposed the type of across-the-board tariffs that Trump has called for.

“If executed, Trump’s latest tariff proposals would increase manifold the distortions and burdens created by the rounds of tariffs levied during the Trump administration, while inflicting significant collateral damage on the US economy,” the institute’s report said.

PIIE said American consumers would first feel the pinch from higher prices that importers charge to offset tariffs. Importers would be forced to pay more or abandon the market.

The total cost to buyers as a share of the US economy would reach 1.8 per cent, taking into account both existing levies on Chinese goods and Trump’s proposed 60 per cent tariffs, the brief added.

Multiple studies have shown that the cost of US tariffs gets “fully passed through to American buyers”, it said.

Retaliatory tariffs add to the impact on common Americans, the policy brief said. It also noted that China’s retaliation against earlier US tariffs eventually covered 58 per cent of US exports to the world’s second-largest economy and averaged 21 per cent, hitting US agricultural exports and capital equipment exports “particularly hard”.

Another outside analysis, according to the institute report, calculated that a 10 per cent tariff would “act like an annual consumption tax increase” of about US$1,500 per American household.

“Research, by and large, finds that the costs of the tariffs were largely passed through as increases in US prices, affecting domestic consumers and producers who buy imported goods rather than foreign exporters,” said Liang Yan, chair professor of economics at Willamette University in the US state of Oregon.

Revenues generated for the US government by Trump’s 60 per cent tariff goal could eventually land in negative territory “when considering the resulting drop in imports and depressed US growth”, the institute warned.

If products are manufactured in Mexico, that would be an alternative for now

On Wednesday, an International Monetary Fund (IMF) official voiced concern over the US-China trade dispute and Chinese friction with Europe.

“We’re seeing … in the last couple of years, the largest number of industrial policies that are getting announced are by the US, the European Union and China,” the IMF’s first deputy managing director, Gita Gopinath, said during a news conference.

The IMF has seen “evidence of very quick retaliation” among the three regions, Gopinath said, estimating a 75 per cent probability of countermeasures within a year after one side takes action.

“So, we are in this space where there is much more risk of having a fragmented trading system,” the IMF official said. “I think that is the environment that we’re in.”

American consumers may get a reprieve if goods sourced from China can be imported from Mexico instead, said Dexter Roberts, director of China affairs with the US-based University of Montana’s Mansfield Centre. Chinese investors are funding some Mexican factories so they can ship to the US without the Trump tariffs, he said.

“If products are manufactured in Mexico, that would be an alternative for now,” Roberts said.