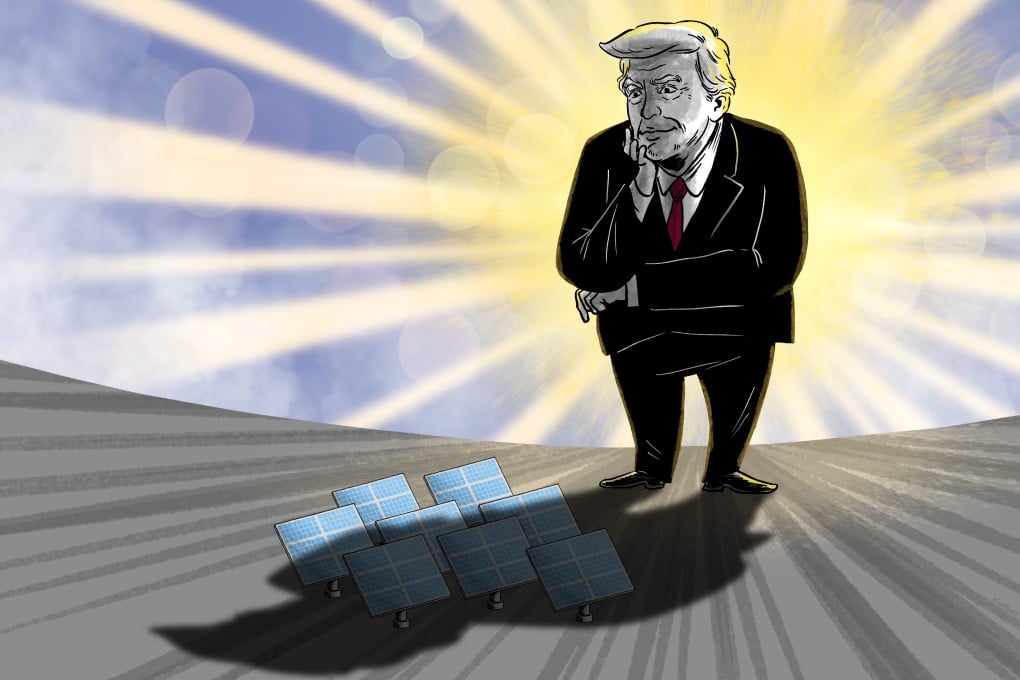

Trump ascendancy casts cloud over Chinese solar firms’ US ambitions

A saturated Chinese market and rising trade barriers overseas take shine off solar panel makers’ prospects

Hours before American voters began casting ballots in the November 5 election that gave Donald Trump a second term as United States president, the board of leading Chinese solar panel maker Trina Solar decided to sell its newly opened factory in Texas to US battery maker Freyr for over US$300 million.

The price included US$100 million in cash and US$150 million in senior bonds – more than covering its original US$200 million investment – as well as a 19.08 per cent stake in Freyr that will allow Trina to be deeply involved in the US company’s operation and management.

“I think this is a very inspiring case and a good reference for everyone,” Ron Cai, a lawyer with decades of experience navigating US-China business transactions, said as he introduced details of the deal to around a hundred solar industry players in Shanghai in late November.

The audience members were seeking the answer to one question: as uncertainties in the green energy sector and hostility towards Chinese companies rise with Trump’s return, is exploring the US market still worth the risk?

While some companies have put their plans on hold, many others are not willing to abandon what is the world’s second-largest solar panel market after China.

At the same event, Li Deyan, the head of Nanjing-based C&D Clean Energy, said: “In fact, it is only because policies keep changing so that we have opportunities. If policies remain unchanged … we cannot make big money.