Advertisement

China’s ‘involuted’ new-energy industry is awash with overcapacity that could stall new economic driver

- Domestic demand is far from able to absorb all of the new EV batteries and solar panels, so Chinese manufacturers have little choice but to sell overseas – if they can

- China’s top leaders acknowledged this week that ‘overcapacity in some industries’ is among the major economic challenges to tackle in 2024

Reading Time:4 minutes

Why you can trust SCMP

11

Ji Siqiin Beijing

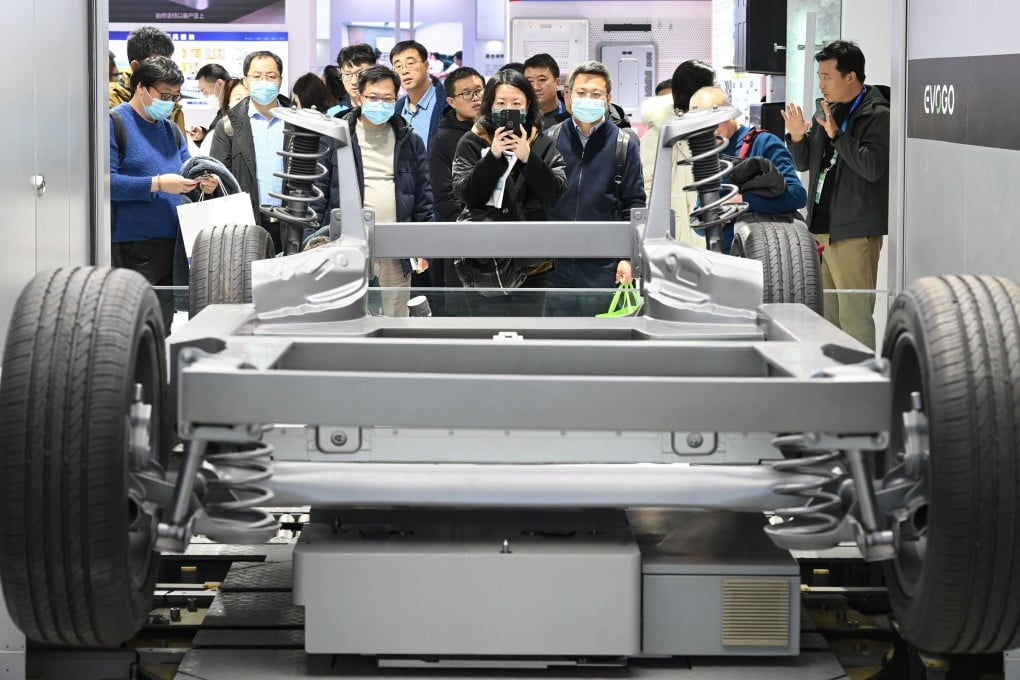

In the year since in-person trade fairs and expos resumed in China following its lifting of pandemic restrictions, exhibition halls across the country have been packed full of chatty sales managers from the new-energy supply chain.

Advertisement

From electric car batteries to solar panels, they peddle their wares to foreign businessmen and bigger industrial peers, handing out business cards and rattling off sales pitches.

However, the deluge of interest in the industry is having a negative knock-on effect of overcapacity. And in the words of industry insiders, it’s become too “involuted”, or nei juan in Chinese – an anthropological term originally used to explain a process in which additional input cannot produce more output.

In recent years, the term has become synonymous in China with being locked in an endless cycle of self-defeating competition. And perhaps nowhere is that better embodied than new energy.

“When the price of lithium rose crazily last year, everyone rushed in. Now it has plummeted, and a large number of firms have failed,” Xie Runqing, the manager of a battery recycler, said in late November at the China International Supply China Expo in Beijing.

Advertisement

Advertisement