China is plugging pension hole by tapping into US$25 trillion in equity in state-owned enterprises

- Beijing wants to invest more of the national pension fund in China equity market to generate better returns than banks or government bonds

- SOE transfers and higher investment income are two of several methods government pursuing to plug hole in pension system

Every month, Liu Yuan sets aside around 900 yuan (US$131), or 8 per cent, of his salary to be paid into the public pension fund, while his employer contributes about 2,000 yuan.

These payments will guarantee the 33-year-old accountant of a construction company in eastern Shandong province a basic monthly pension payment of around 4,000 yuan a month when he retires in 25 years, all other things being equal.

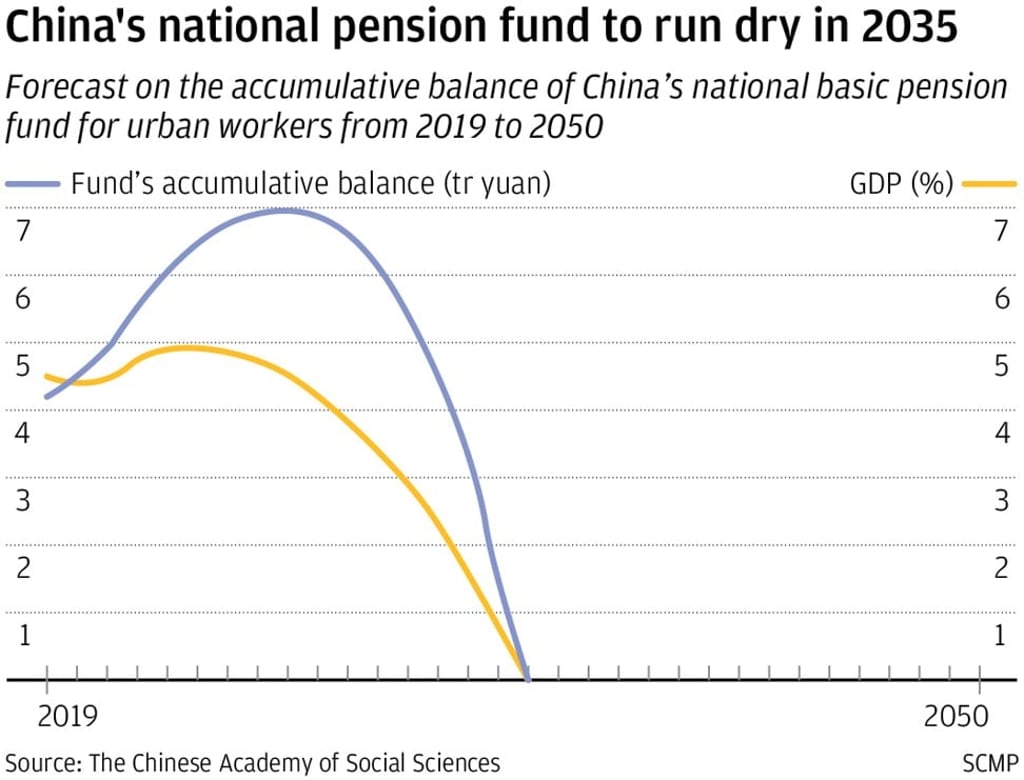

But starting this May, his employer can cut the mandatory contribution to his account by about 200 yuan each month, as a new national policy to reduce the burden of social payments on companies takes effect. This could affect the future financial security of hundreds of millions of urban workers in the country.

The policy will cut employers’ pension contribution rate from as high as 20 per cent for each employee’s salary to 16 per cent that Beijing believes will help stabilise growth and employment as China faces its worst economic slowdown in decades amid an escalating trade war with the United States.

It also includes lowering companies’ mandatory contribution for the highest income earners, calculated based on a cap of no more than three times the average salary for the province or city, and for those who earned the least to draw more firms or self-employed people to contribute to the pension scheme.

“The policy [to cut contributions] is a necessary move to stabilise employment. It’s aimed at reducing companies’ burden and boosting their earnings, which are already struggling amid the economic downturn,” said Ma Wenyu, a macro analyst at Shenzhen-listed Shanxi Securities.