US recession chance ‘no more than 25 per cent’ says Chicago Federal Reserve chief as fear grips markets

- Asian stock markets plunged on Monday, with benchmark indices declining from Seoul to Sydney, after the Dow Jones Industrial Average plunged on Friday

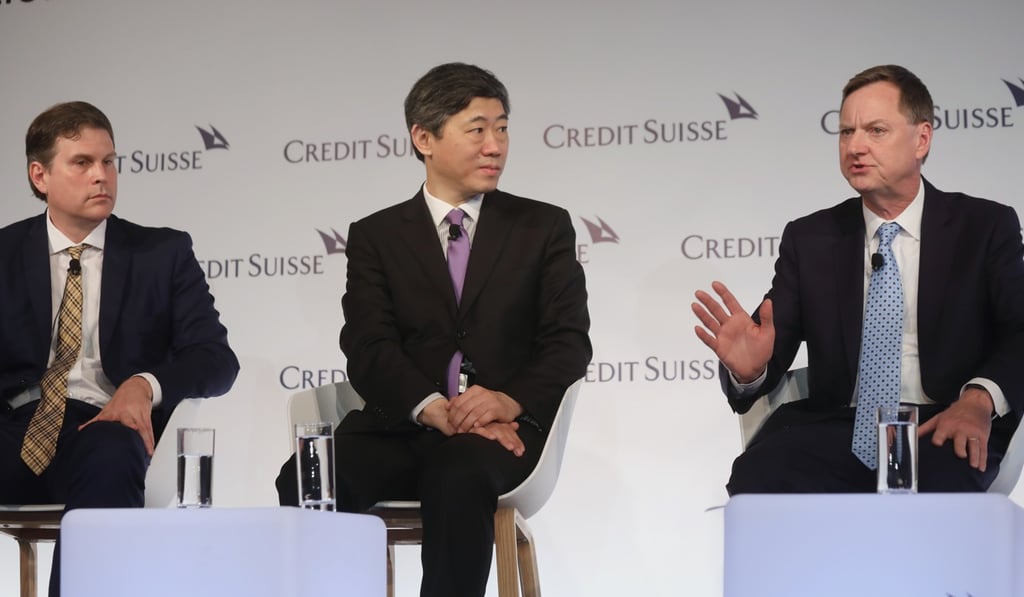

- Charles Evans says the US Federal Reserve’s monetary policy is appropriate and it is keeping its eyes on economic data

The chance of a recession in the United States is “not extraordinary”, according to the president of the Chicago Federal Reserve, conveying a more benign outlook for the world’s largest economy than the fear that has roiled stock markets from New York to Sydney.

Growth in “the US economy has slowed but is still robust”, said Charles Evans, with the United States’ US$21 trillion economy expected to grow by about 2 per cent this year, which is “pretty good”, putting the probability of a recession at no more than 25 per cent.

“The US economy is on good footing,” he added. “Fundamentals are strong. The Fed Funds rate is at a decent level. Growth is expected to be between 1.75 per cent and 2 per cent this year.”

The benign outlook by Evans, who has been the head of the Chicago Federal Reserve since 2007, contrasts with the global fear of a contraction in the US economy.

Asian stock markets plunged on Monday, with benchmark indices declining from Seoul to Sydney, taking the cue from the 460-point drop in the Dow Jones Industrial Average on Friday.