Advertisement

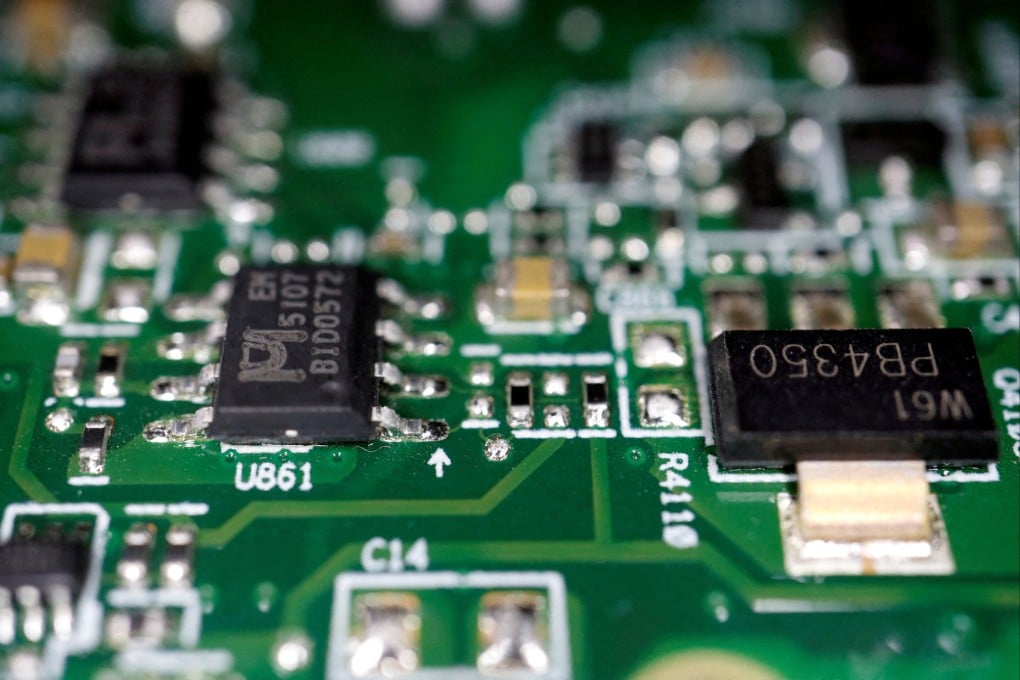

The View | For semiconductor self-sufficiency, China must collaborate, not just innovate

- The Western semiconductor landscape is an intertwined global network, fostered by decades of collaborative research and intellectual property sharing

- Beijing must learn to marshal its domestic and international resources in a similar way to realise its ambitions

Reading Time:3 minutes

Why you can trust SCMP

15

As Nvidia’s market capitalisation exceeds US$2 trillion and eclipses that of energy giant Aramco, the milestone highlights the importance of intellectual capital in the AI era, when advanced chips are crucial.

Advertisement

At the same time, US export restrictions on chips have pushed the American tech company to try selling downgraded artificial intelligence chips to its Chinese clientele. But these chips were poorly received. The mismatch underscores the complex challenges faced by China in moving up the semiconductor value pyramid towards self-sufficiency.

China has scaled commanding heights in a few technological fields, including 5G and electric vehicles. In each of these areas, China was able to achieve success as it has built a complete ecosystem with most critical components available locally – except for some imported chips. A new car typically has more than 1,000 chips, with the majority being mature node chips manufactured in China.

China is the top semiconductor market, with sales of about US$180 billion in 2022 representing more than 30 per cent of the global total. It leads the world in both exports and imports of semiconductors. Mainland China, Taiwan, South Korea and Japan account for more than 80 per cent of global semiconductor fabrication. However, although manufacturing is centred in East Asia, critical chip design software and manufacturing equipment remain controlled by the West.

China’s semiconductor industry has made strides in recent years through heavy investment and government support. Huawei’s HiSilicon is a world-class designer of integrated circuits. Long seen as lagging behind Taiwan Semiconductor Manufacturing Company, China’s Semiconductor Manufacturing International Corporation (SMIC) surprised the world last year with the advanced 7nm processor featured in Huawei’s phone.

Advertisement

Furthermore, SMIC may soon work with Huawei to produce next-generation chips in Shanghai. With persistent investment, China aims to climb the semiconductor value chain and reduce dependence on imported high-end chips.

Advertisement