Advertisement

Opinion | How China’s digital yuan could work in a dual-currency socialist system

- China could split the e-CNY into onshore and offshore versions, have a freely tradeable yuan-pegged stablecoin or participate in a universal CBDC

- If China does decide on universal basic income, digital yuan payments could easily be programmed to be spent only on necessities

Reading Time:4 minutes

Why you can trust SCMP

2

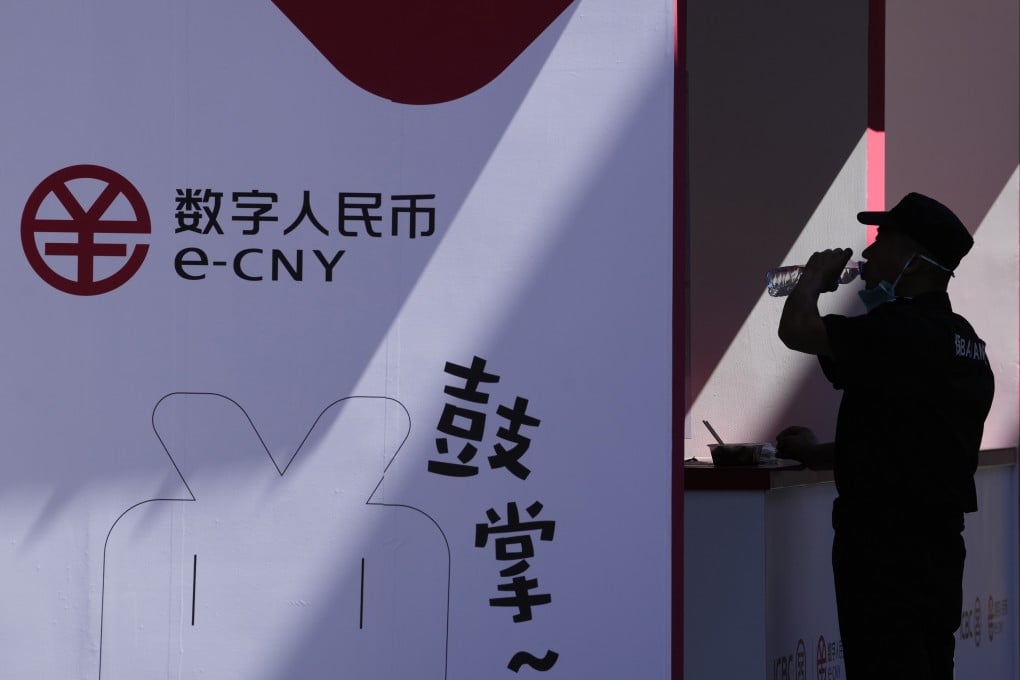

At Hong Kong FinTech Week, there were lively discussions on and demonstrations of the growing uses of China’s digital yuan, the e-CNY. The growing momentum is no surprise. China is the first major economy to roll out a digital currency and a front runner in central bank digital currencies (CBDCs).

Advertisement

But what does this mean under China’s unique dual-currency and socialist system?

CBDCs like the digital yuan function like traditional banknotes but exist entirely in digital form and are registered on a centralised ledger. Their digital nature enables them to be more efficiently distributed and, crucially, programmable – from spending restrictions to triggers and limits.

I have written before about how China, under its socialist system, may embrace the dividends of artificial-intelligence-generated productivity gains to introduce universal basic income.

CBDCs could complement this by ensuring the digital yuan issued under the initiative can only be spent on certain categories such as food, utilities and education, therefore encouraging the working population to remain productive. The government could also programme negative interest rates to boost consumption.

Advertisement

Moving to a CBDC would be relatively straightforward for most currencies. But China has always kept a tight control of the yuan, to shape and protect its economic model. The reins only loosened in 2009, when restrictions were lifted on yuan trade settlements between the mainland and Hong Kong. It was the first time the government had allowed offshore yuan settlements and marked the acceleration of yuan internationalisation.

Advertisement