Macroscope | Economic turmoil looms as US debt ceiling crisis drags on

- With Republicans and Democrats going into election mode, the US debt ceiling stand-off could go down to the wire, with financial markets suffering extreme pain

- Investors who remain oblivious to the risk of default should note that sovereign players like China are already selling down their US Treasury holdings

There’s a very good chance the world is sleepwalking into another global financial crisis. With Capitol Hill still effectively gridlocked over the US debt ceiling, the clock is ticking and it’s only a matter of time before markets hit the crash barriers.

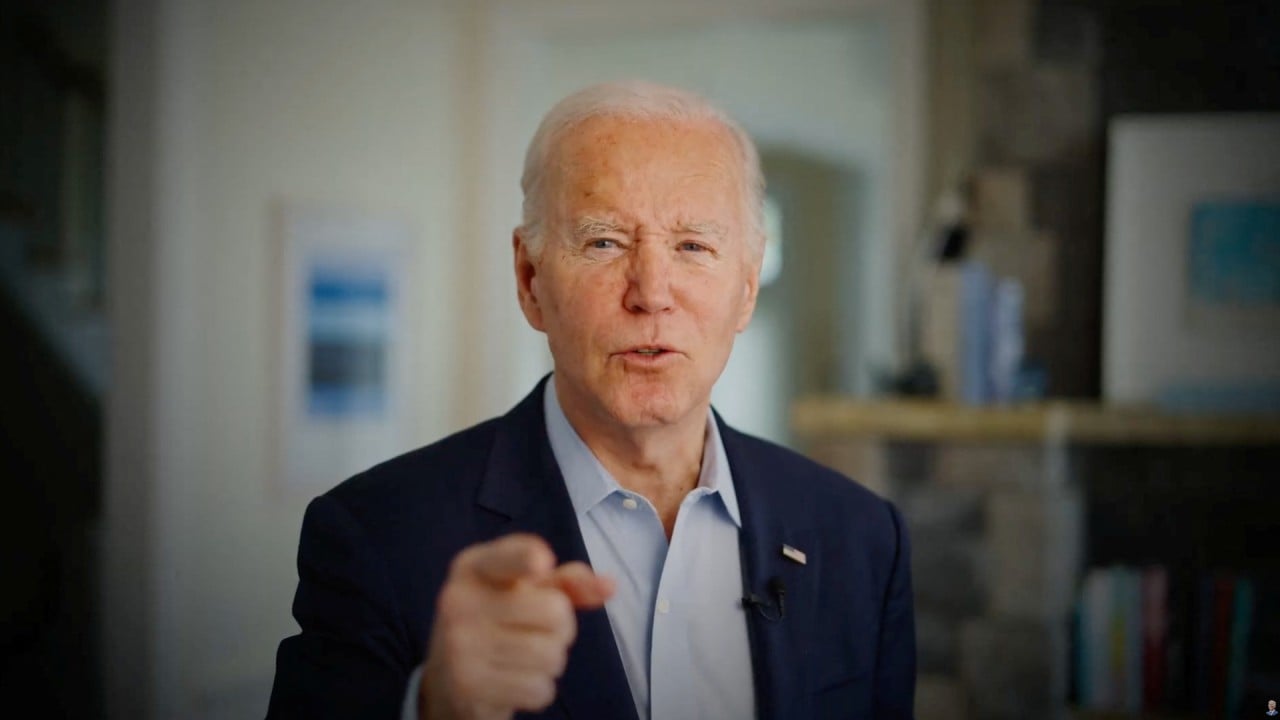

There’s too much at stake as the proposed Republican cuts in US government spending go too close to the bone of Biden’s domestic reflation initiatives to reboot growth and rebalance the economy. The impasse over fiscal policy has simply been kicked down the road for lawmakers to resolve next year, meaning investors are at great risk.

House Speaker Kevin McCarthy has insisted the Republican Party would never allow the US government to default on its debts, but that’s not to say a major credit event is never going to happen. With US government debt currently running at 120 per cent of gross domestic product and nearly twice as high as the level preceding the 2008 global crash, it’s unsustainable over the long term.

The market’s appetite for US government assets is fast reaching a critical point. Either the US government embarks on major cost-cutting austerity, or it needs to grow its way out of the debt crisis. The Republicans and Democrats are deeply at odds and seem irreconcilable.