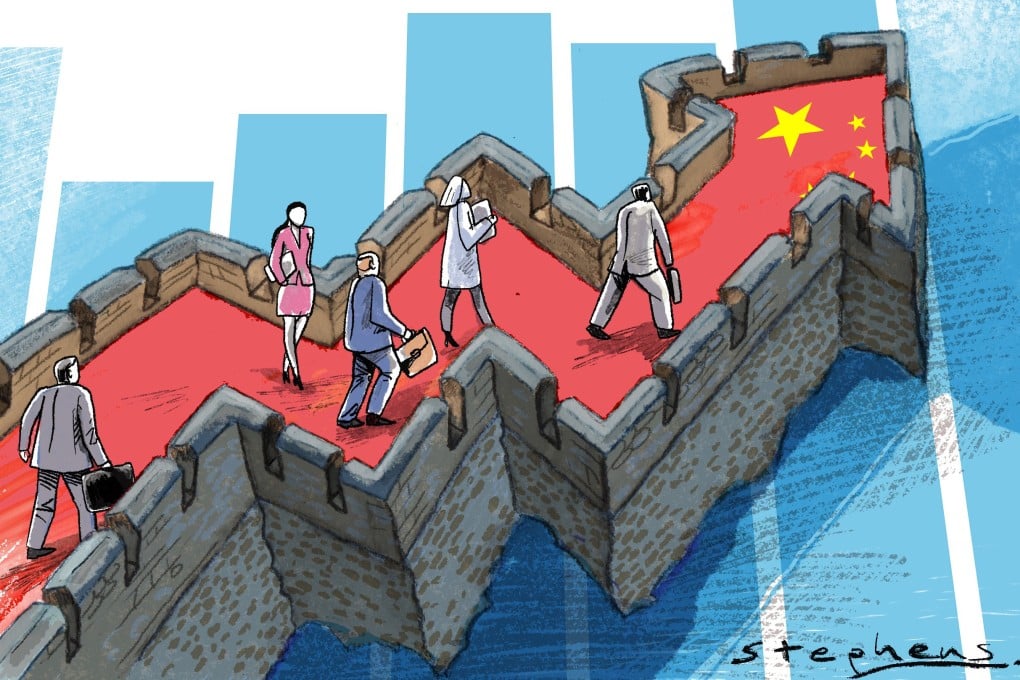

Opinion | With the right keys, China is still a most attractive investment option

- The key is to gain a good understanding of the economy, honestly assess its potential and risks, and seek the best entry points to the market – such as Hong Kong

Is China still investible? This has been a hot topic. Experts all over the world have been expressing all kinds of views, many of which are quite different and even contradictory.

For investors and entrepreneurs seriously thinking of doing business in China, this leads to three main puzzles: how to understand China’s economy correctly; how to assess its potential and risks comprehensively; and how to access the Chinese market conveniently.

The third are the important speeches made by the president and premier at major events. These three types of materials are important because Chinese government officials at all levels will follow them.

Second, how to assess the prospects and risks of China’s economy. Two things need to be pointed out. One, a reading of China’s economy through the lens of classic Western economics may not be sufficient or accurate.