The View | Why China’s move up value chain means Dell’s departure is no big deal

- Rather than being alarmed and making conclusions about the entire economy, the Dell news needs to be put in context of China’s development

- Labour-intensive industries are leaving the country to be replaced by higher value-added sectors, and China’s advantages are hard to replicate elsewhere

The world’s third-largest personal computer manufacturer, behind Lenovo and HP, had a market share of 11.7 per cent in the third quarter of 2022 in China. Besides the three leading players of Lenovo, HP and Dell, there are a number of Chinese mainland and Taiwanese players offering competitive products. Compared to smartphones, internet-of-things products and smart cars, personal computers have seen less innovation.

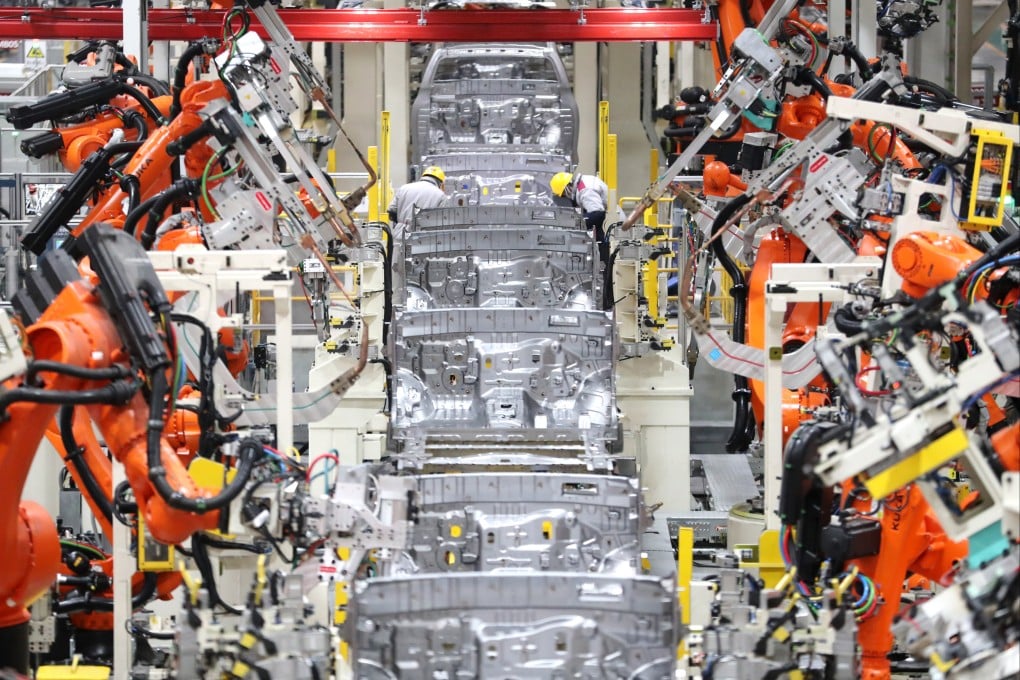

Most of the supply chains that have left China involved relatively simple design and production processes that require minimal research and development and little ingenious product prototyping. The relatively stable nature of these product developments implies networks of suppliers of inputs do not change much.

While personal computers require quite a few parts, it is gradually becoming a commodity product. Replicating or moving the supply chain of personal computers away from China is possible, though this could incur higher costs. Dell’s costs of supply chains set up elsewhere could be 15 to 20 per cent higher than those in China.

Dell might also lose part market share in China. Government and state-owned companies in China will replace foreign-branded computers and software with locally developed products by mid-2024, according to Bloomberg.