Advertisement

Macroscope | Asian central banks are locked in a losing chess match with the US Federal Reserve

- Asian central banks facing currency weakness are stuck with no good moves as the Fed presses forward with interest rate increases and quantitative tightening

- Short of a dramatic reversal of the market’s current bullish view of the US dollar’s prospects, China’s central bank might be limited to managing the rate of descent of the yuan versus the US currency

Reading Time:3 minutes

Why you can trust SCMP

2

The year 1972 saw the legendary chess duel in Reykjavik between the Soviet Union’s Boris Spassky and Bobby Fischer of the United States. Half a century on, Asian central banks find themselves locked in a monetary policy chess match with the US Federal Reserve that is being played out on the foreign exchanges.

Advertisement

Asian central banks seeking to address local currency weakness in the face of Fed-related US dollar strength are essentially in zugzwang, a chess term applied when a player has nothing but bad options available.

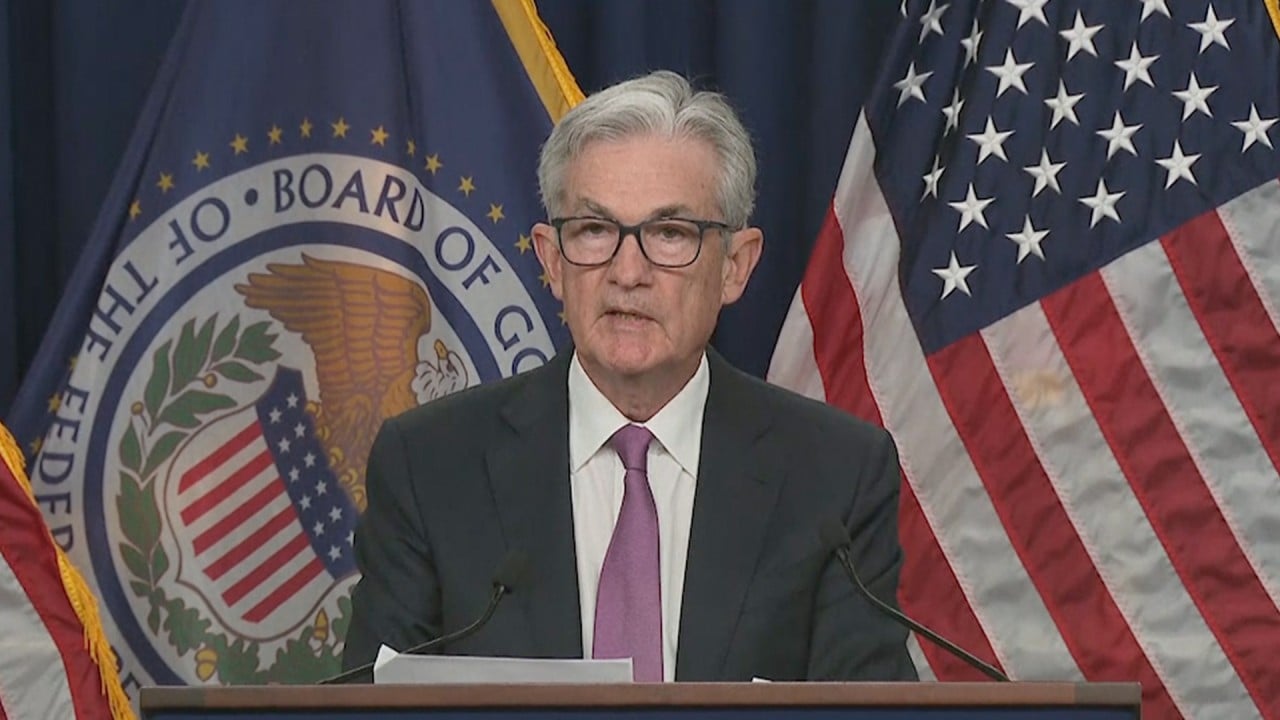

Slow to recognise the danger from higher US consumer price inflation, the Federal Reserve has now enthusiastically taken the offensive. Interest rate increases and the initiation of quantitative tightening will see the Fed’s balance sheet shrink as it removes liquidity from the US monetary system.

Only reinforced by the US jobs report last week, more US rate increases are in the offing. The Fed is likely to keep those rates higher for longer as it seeks to checkmate elevated inflation.

Another rise in US interest rates seems almost certain on September 21, the only question being if it will be a further 0.75 per cent move or “just” 0.5 per cent. As for quantitative tightening, how that ultimately plays out is as yet unclear, but it has to make US monetary policy more restrictive in the same way that quantitative easing was expansive.

Meanwhile, the Biden administration has pushed through expansionary fiscal legislation, not least the recent US$430 billion Inflation Reduction Act. In currency market terms, and today is no exception, tighter US monetary conditions and looser US fiscal policy often equate to marked US dollar strength.

Advertisement