Advertisement

The View | As China’s focus switches from property to capital market development, who will benefit?

- When President Xi Jinping announced the launch of the Beijing stock exchange, it signalled the highest level of support for capital market development

- Beijing intends to redirect household savings away from property and into stocks and other capital market products, and financial services can be the bridge

Reading Time:4 minutes

Why you can trust SCMP

So, what’s next for China, following the government’s crackdown on real estate? We all know that sectors currently in favour include priorities such as semiconductors, green energy and biosciences.

Advertisement

But here’s the surprise: financial services, too, will be a big winner. In Chinese state capitalism, the winners and losers are chosen by the government at each stage of the country’s development. Right now, Beijing urgently needs to upgrade the nation’s capital markets.

The current policy is to shift household savings away from property and redirect them into productive uses. But how can this be done? The bridge has to be financial services.

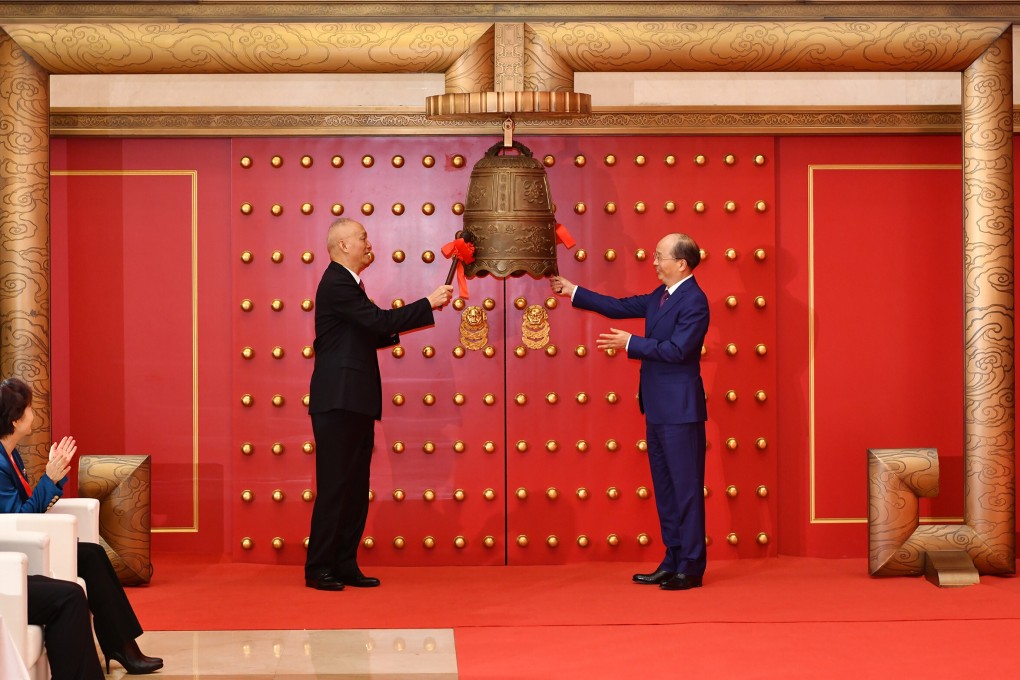

When President Xi Jinping personally announced the launch of a third stock exchange, in Beijing last year, it signalled the highest level of support for capital market development. The Beijing exchange duly started trading towards the end of 2021, becoming the mainland’s third exchange after Shanghai and Shenzhen.

Redirecting savings is not easy, given that the Chinese public has been preoccupied with property for the past two decades. Currently, real estate represents an estimated 40 per cent of household wealth and about 25 per cent of the country’s economic activity.

Advertisement

In recent years, the government has been restricting property purchases. “Red lines” were introduced to curb excessive borrowing by developers. It’s not the government’s intention to cause a crash, as that could put social stability at risk, but clearly, the time has come to put an end to excesses.

Advertisement