The View | Potent mix of art NFTs, cryptocurrencies and central bank digital currencies promises to be a regulator’s nightmare

- The explosion of the art NFT market and growing popularity of digital currencies have raised concerns that they could become tools for money laundering

- But, rather than banning such emerging technologies, regulators must fine-tune legislation and policies to counter the threat

Additionally, NFTs provide authentication for a variety of other assets by offering a blockchain-based certificate of authenticity for such items.

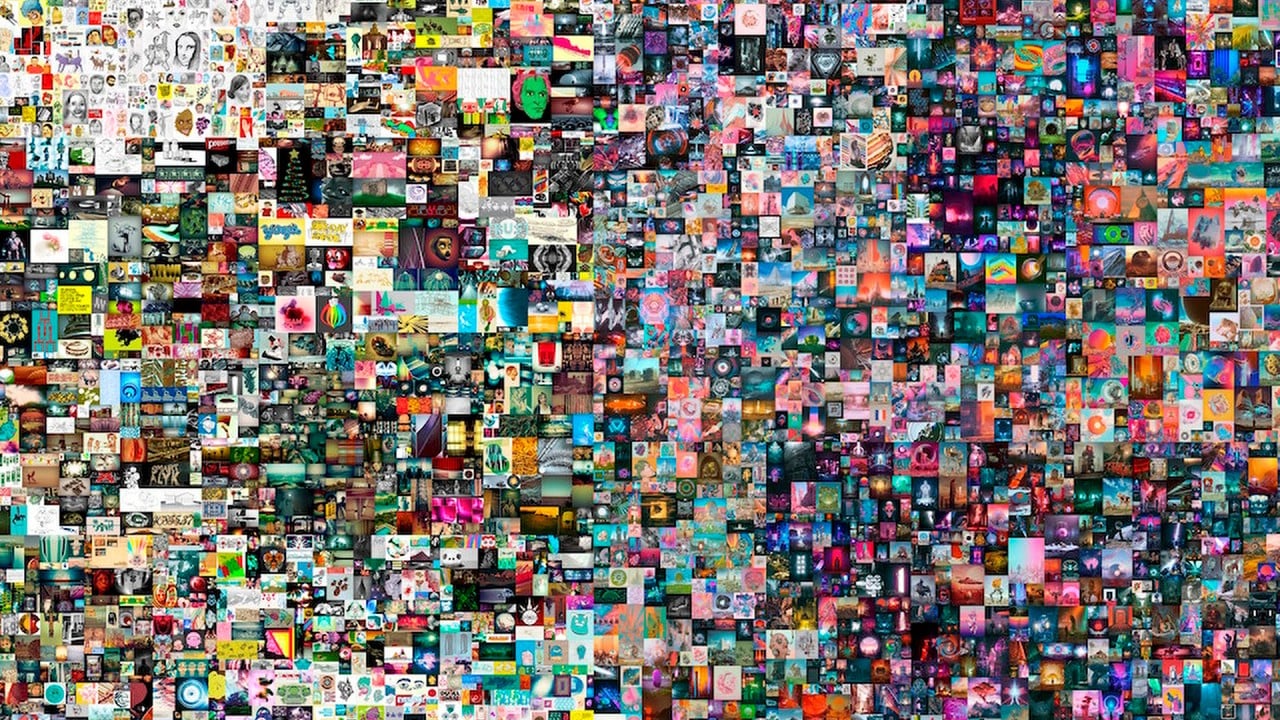

The digital artwork craze tied to NFTs has created a significant market, worth over US$250 million last year. This dramatic increase in the NFT-related market has raised significant concern about these tools being used to support money-laundering operations.

Anti-money-laundering regulations have greatly restricted the flow of funds for threat actors through traditional banking mechanisms. However, the rise of the art NFT market, along with the growth of central bank digital currencies (CBDCs) in parallel with cryptocurrencies, should greatly concern anti-money-laundering specialists and the financial industry at large.