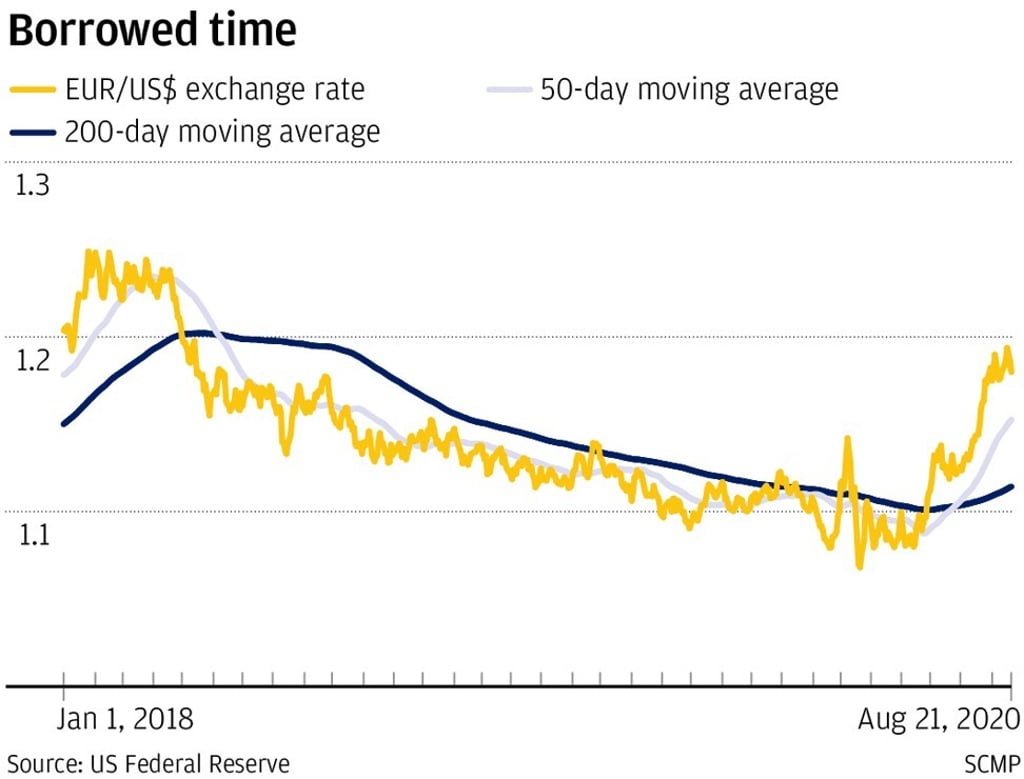

Macroscope | With European economies mired in recession, is the euro living on borrowed time?

- The rebound in the euro is simply the flip side of the US dollar being undermined by uncertainty about the presidential election. The monetary muddle in Europe won’t help the currency after the dust settles in America

Given the way the euro has been rallying in the foreign exchange markets over the past three months, you would be forgiven for thinking the currency has become a beacon of stability in uncertain times. You couldn’t be further from the truth.

The rebound in the euro is simply the flip side of the US dollar being undermined by growing uncertainty about the upcoming US presidential election in November and how the US authorities are coping with the coronavirus crisis. Global investors are simply taking time out from long dollar exposures, and euro bulls are simply filling a temporary void. It won’t last long.

Despite close to 3 trillion euros of assets purchased so far under the ECB’s quantitative easing programme and interest rates steeped in negative territory, the economy of Europe is showing precious few signs of a return to normality.