Advertisement

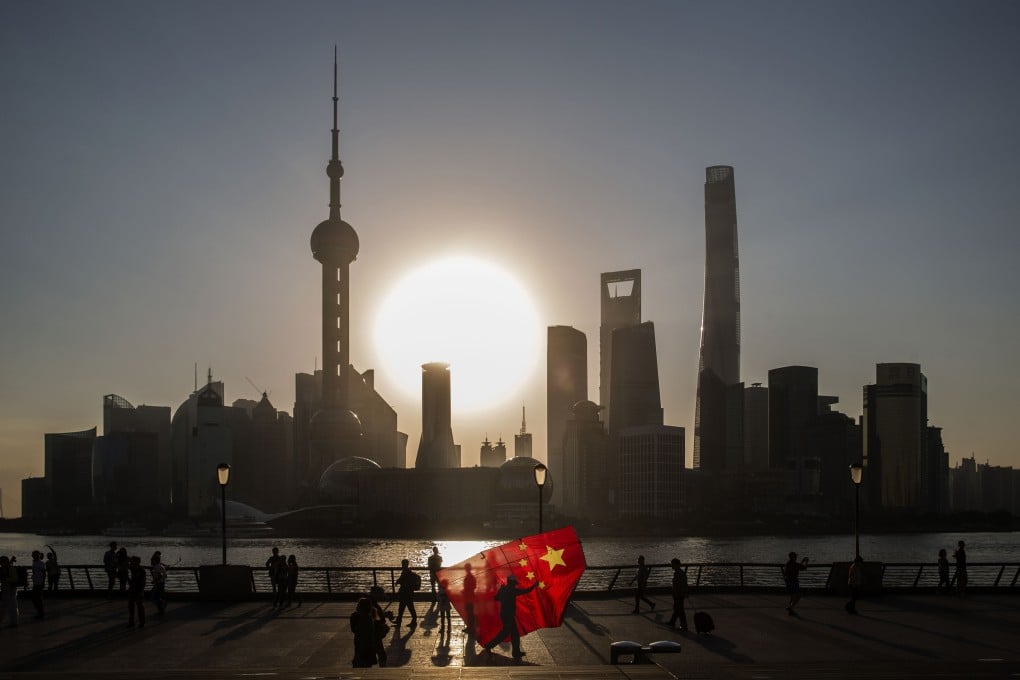

As China’s dream of ‘aircraft-carrier-sized’ investment banks takes shape, it must not repeat US mistakes

- China is allowing foreign banks to control securities firms, but also seeking to create national champions by allowing its biggest commercial banks to offer investment banking services

- To avoid a repeat of the US’ experience of financial crises, Chinese regulators must be on guard against banking excesses

Reading Time:3 minutes

Why you can trust SCMP

0

US President Donald Trump’s trade war has put China under heavy pressure to liberalise its financial industry. In concessions made during trade talks, China agreed to allow foreign banks to take up to a 100 per cent stake in Chinese securities firms from April 1. The policy shift opens China’s US$21 trillion capital markets to foreign investment banks and hedge funds.

Since the new rule, there are now five securities firms controlled by Goldman Sachs, Morgan Stanley, Nomura, JPMorgan and UBS putting domestic securities houses under intense pressure.

While China’s commercial banks rank among the world’s largest, its securities houses are small compared to the global giants – China’s 130 securities firms put together cannot match JPMorgan Chase alone. To create national champions, the Chinese Securities Regulatory Commission recently announced that it would grant securities licences to commercial banks.

Commercial banks take deposits and make loans to consumers and businesses whereas investment banks help large corporations to raise long-term capital by underwriting, issuing and distributing stocks, bonds and other securities.

Previously, Chinese commercial banks were not licensed to offer investment banking services, but the country now wants to create “aircraft-carrier-size” investment banks to compete with powerful foreign players. To do this, it is allowing its biggest commercial banks – Industrial and Commercial Bank of China (ICBC), China Construction Bank, Agricultural Bank of China and the Bank of China – to enter the business.

Advertisement