Opinion | Short of a budget deficit shock, here’s how to ensure Hong Kong spends money more wisely

- Philip Bowring says years of huge surpluses have allowed government incompetence to continue unchecked, wasting money on needless capital investment. With budget season coming around again, here are four measures to improve this year’s plan

This is not the hope of either a frustrated pessimist or the holder of a short position on the Hong Kong market. It stems from the need for Hong Kong’s public finances to escape from the drug of overpriced land. The government will never do anything itself in that direction, notwithstanding promises of increased land supply. It is hooked, to the detriment of the economy and society.

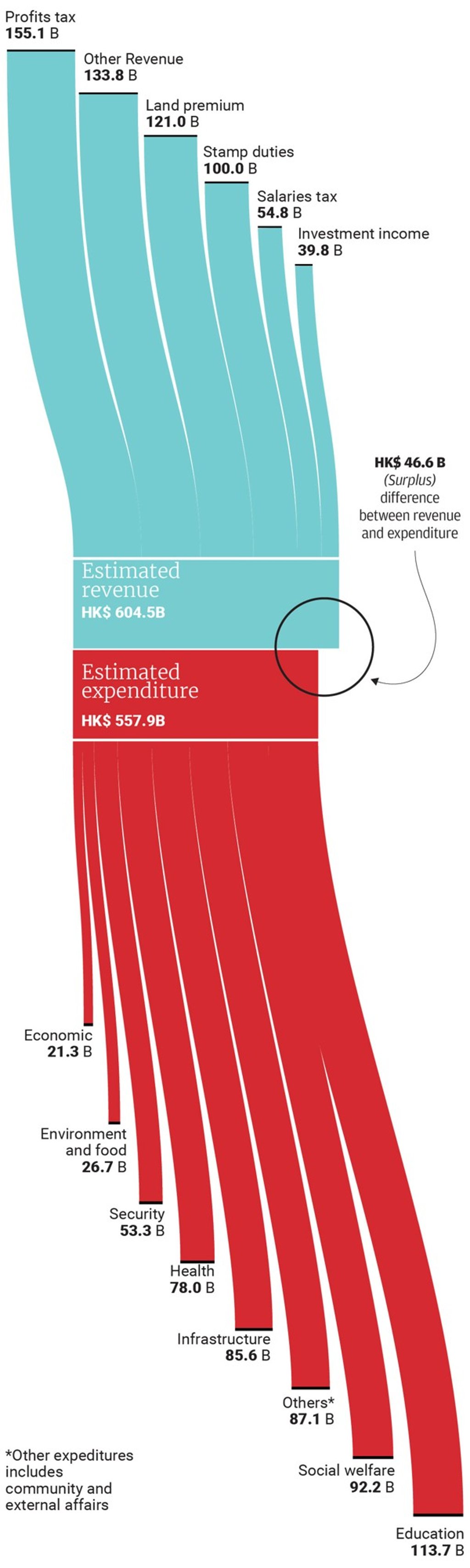

Thus, a sustained fall in land prices, particularly if brought about by higher real interest rates, may finally shake up a government which, for most of the past two decades, has used land-related revenues (stamp duties and a share of profits tax) as a cover for fiscal incompetence. Stable, recurrent revenues from income and profits tax and rates have been slashed, mainly for the benefit of the top 30 per cent of households.

The enrichment of government coffers has been at the expense, directly or indirectly, of the majority of citizens. It has led to poor investment returns and reduced both capital and consumption spending in sectors other than property. Sustained fiscal surpluses are nothing to boast about. They are a distortion, particularly when the costs of capital are so low as to encourage bad investment.

Worse still, the steep rise in land sales revenues has enabled a grotesque blowout in capital spending from HK$75 billion in 2015-16 to an estimated HK$116 billion for 2018-19 and a projected HK$139 billion by 2021-22. Much of this has been on prestige projects with minimal returns which could never be commercially financed. Spending has been inflated by diverting all land sales revenue into the capital budget.