Why Hong Kong is failing to rein in housing prices

Victor Zheng and Roger Luk say the government’s control measures, which are meant to favour end users, are in fact working at cross purposes due to the over-regulation of mortgages. As a result, the secondary market is stagnant and unable to match supply with demand to moderate prices

When the global financial tsunami hit in September 2008, Hong Kong’s housing market was already grossly imbalanced, with a mismatch in demand and supply. Owing to the city’s linked exchange rate system, low interest rates and quantitative easing in America, excessive liquidity has altered the landscape of the housing market.

Demand for Hong Kong flats appears to defy cooling measures

Since 2009, the government has introduced various measures in an attempt to cool excessive demand, including increasingly aggressive controls, from 2012 onwards, that are meant to prioritise homebuyers and depress investment demand, particularly from non-residents. Yet, prices had risen a further 50 per cent by the end of last year, notwithstanding the fact that the US Federal Reserve had started to raise interest rates a year earlier, in 2015.

Hong Kong bureaucrats fear negative mortgages and systemic risk ... but they fail to see that the subprime mortgage crisis was unique to America

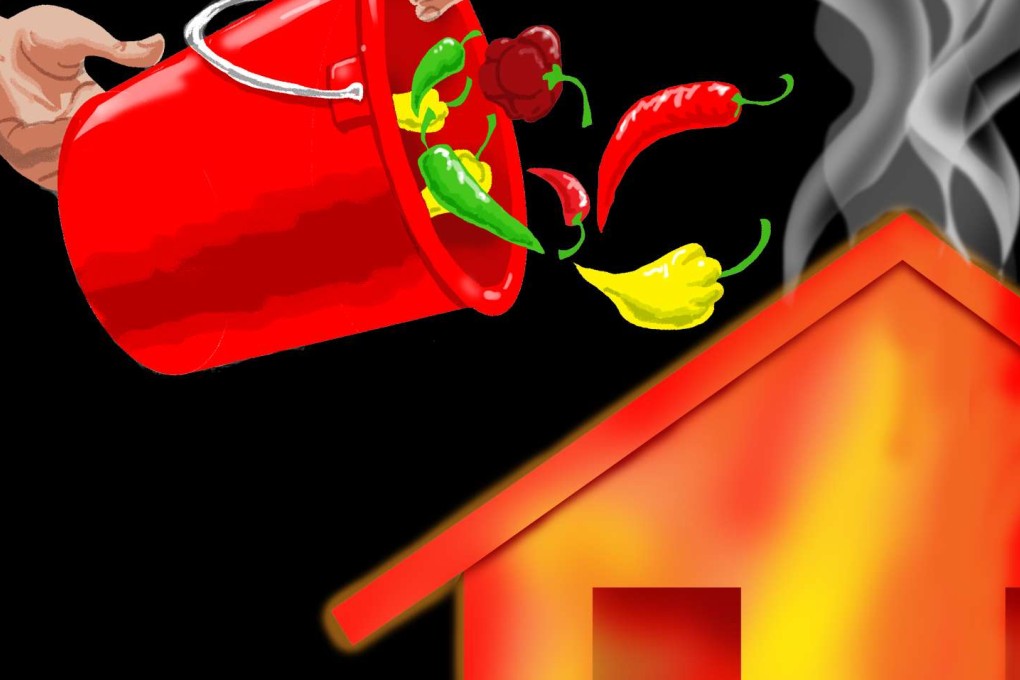

The measures were supposed to drive away speculators and investors, leaving behind end-users. But it has not been the case. Where did the “spicy” measures go wrong?

The taxation measures set out to suppress non-user demand with a levy, while the mortgage measures are meant to give users priority. Together, they are supposed to facilitate the ownership of housing at an affordable price with affordable financing. Unfortunately, as it turned out, the measures worked against each other, with undue restrictions on mortgages offsetting the advantages in taxation.

Mortgages are probably the safest form of lending but our bureaucrats think otherwise. With the financial crises of 1997 and 2008 still fresh in their minds, they fear a recurrence of negative mortgages and systemic risk. Those so-called “countercyclical” measures – including a 40 per cent down payment, stress test, maximum tenure, maximum debt service requirements and so on – induce a sense of comfort among bureaucrats, but they fail to see that the subprime mortgage crisis was unique to America.

Hong Kong housing is built to serve the market, not the people