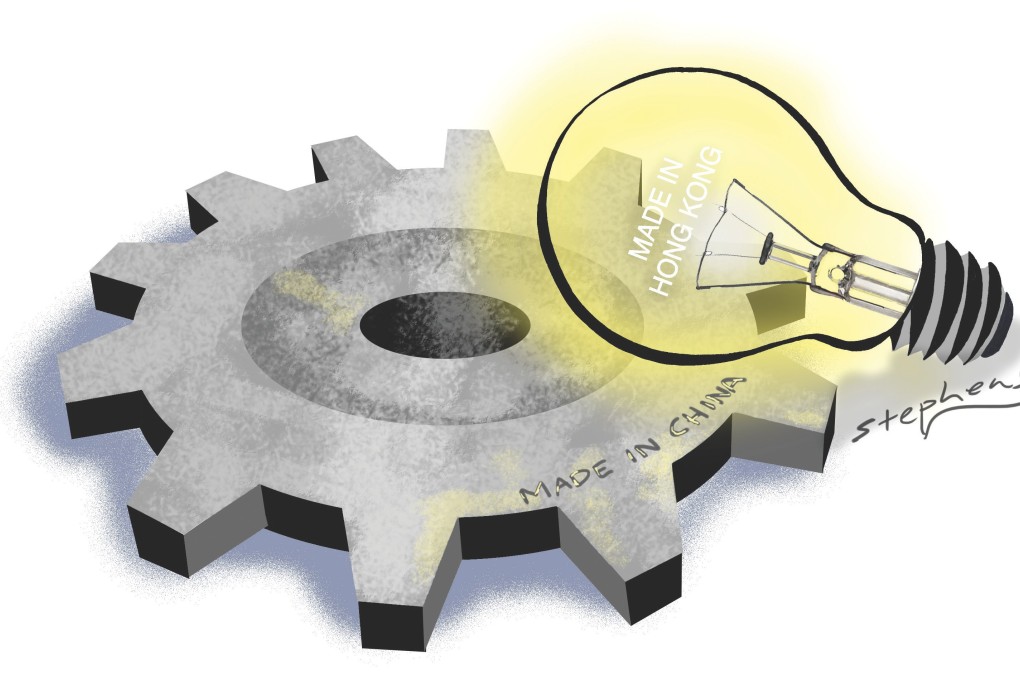

Hong Kong must develop its edge in tech research to join China's manufacturing revolution

Stephen Wong says China's push to raise its manufacturing game gives Hong Kong the chance to play a key role

Since Germany's manufacturing sector officially unveiled its Industry 4.0 blueprint in 2013, their competitors have begun to realise that the combination of all the current technological advances - such as the internet of things, sensors, the cloud, 3D printing, robotics, advanced analytics, big data and the like - will fundamentally change entire production lines and supply chains.

Bill Gates has a famous saying: "We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next 10." This insight may also be applicable to Industry 4.0: the immediate hype will eventually fade, but in 10 years' time, when people look back, they will probably be amazed at how much change has occurred.

In the past, technological advances helped mass production through economies of scale; but for Industry 4.0, each production output can have its own specifications, which will drive how it is made on the production lines. Production will become more tailor-made, supply chains more fragmented and customers more flexible.

It has been estimated that the total related investment spending in Europe will exceed €140 billion (HK$1.2 trillion) every year. Some people have even called this the fourth industrial revolution, comparing its impact favourably to the advent of the steam engine in first industrial revolution in the 18th century, electricity in the second revolution in the 19th century, and computers in the third revolution in the 20th century.

These developments present both an opportunity and a challenge to China's manufacturing sector. China has come up with its own version of Industry 4.0 - "Made in China 2025", which was launched earlier this year. While China has always aimed to upgrade its production in the value chain by relying more on technology and design and less on cheap labour and artificially low exchange rates, the "Made in China 2025" plan is certainly the most ambitious articulation of such a goal.

In a way, the showdown between Germany's Industry 4.0 and "Made in China 2025" will determine whether China can successfully transform from a low-value manufacturing hub into one of hi-tech manufacturing, for example, in large-scale industrial robotics used in auto manufacturing.

Of the four largest industrial robotics companies globally, two of them are German and one is Japanese. Obviously, the challenge for China is that the gap between German and Chinese manufacturing technology is very big, but, looking at it positively, there is an opportunity for China to catch up or even excel. China might have a chance to make use of a "last mover advantage" to leapfrog into the top echelon of manufacturing elites.