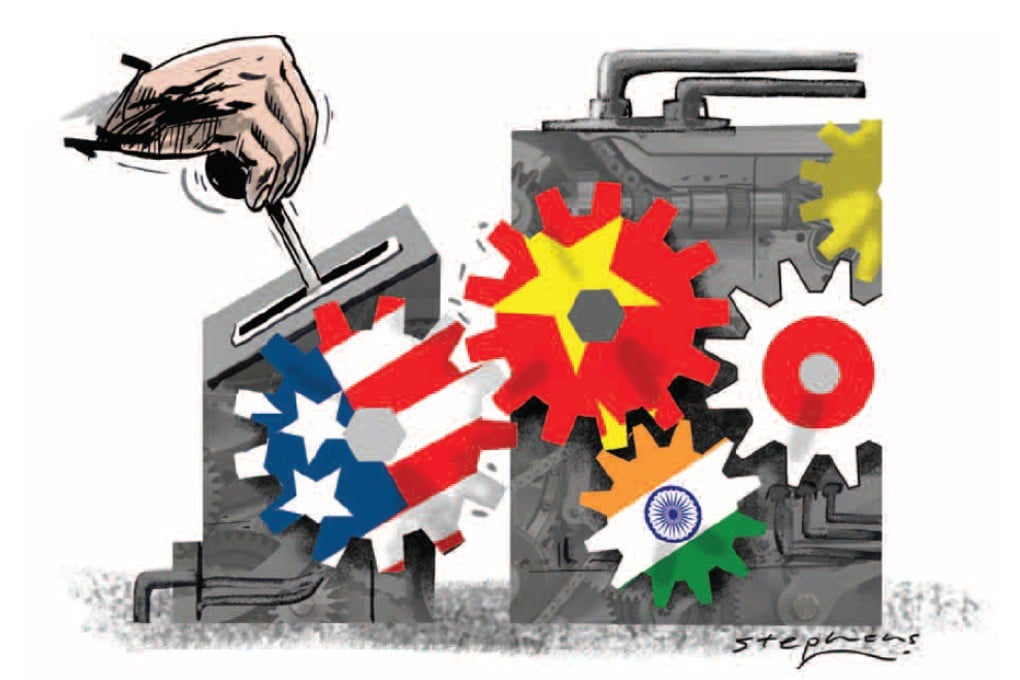

How US tapering and politics will shape growing Asia

Simon Tay and Nicholas Fang assess the challenges for Asia and consider how politics, both domestic and foreign, will shape the buoyant economies of a region on the rise

In the aftermath of the 2008 global financial crisis, two key phrases that conveyed the essence of the recovery strategy were "unconventional monetary policy" and "the new normal". The developed world would pump up credit and lower interest rates to try to resuscitate failing companies and their economies. These measures would ease off once things stabilised, but there would be no return to prior years of heady growth.

After five long years, it seems that future has now arrived.

The biggest transition in the global economy today is the US Federal Reserve "tapering". The good news is that this comes on the back of improvements in the American economy, including job figures and a show of confidence among corporations and consumers. The not-so-good news is that the growth will not be strong by pre-2008 standards.

There is also potentially negative news on how this plays out for the rest of the world. Policy stability in the US cannot be taken for granted, especially after the world has seen how dysfunctional beltway politics shut down Washington. Remember mid-2013? Rumours of the tapering sent markets tumbling - especially in India and Indonesia.

As America shifts, emerging and Asian markets must adjust. They outperformed the West throughout much of the crisis years, but most have now stumbled and may be mired in a middle-income trap unless they reform and upgrade. China is doing better than others and, even so, its future is of slowing, single-digit growth.

The US tapering is, moreover, not the only major transition. Asia's two largest economies are also going through complex changes that can have outsized implications for others.