Corporate China | Is the Alibaba-Yahoo dance set for a new phase?

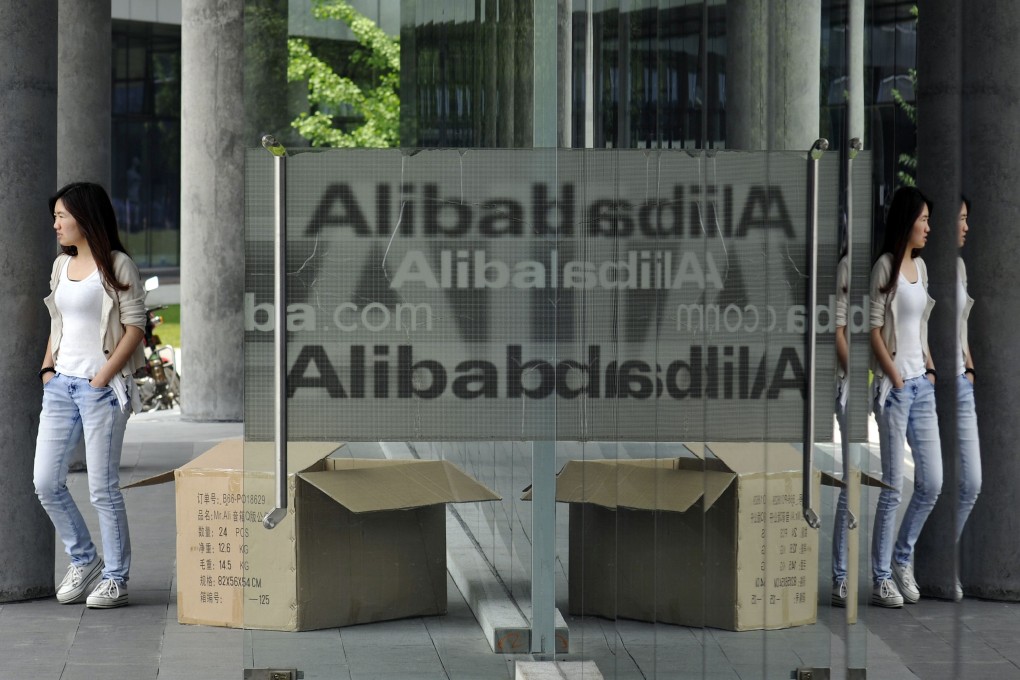

Media have been focused these last 2 days on reports of a new mega purchase by Alibaba (NYSE: BABA) in the insurance space, but another report centers on a far more intriguing possible deal involving the e-commerce giant's long relationship with faded US search giant Yahoo (Nasdaq: YHOO). That particular relationship has undergone huge changes since the pair first formed their partnership a decade ago, and could easily be the subject of a book. In the latest chapter to that story, a new report is speculating that Alibaba could make a bid for Yahoo in the next year as it seeks to go global following its blockbuster IPO in 2014.

Alibaba has been in the headlines nearly nonstop since last September, when it raised a record US$25 billion in a New York IPO that made it one of the world's most valuable Internet companies. Many of the headlines since then have involved acquisitions and strategic tie-ups, as Alibaba tried to show the world why it was worth more than other premier Internet names like Amazon (Nasdaq: AMZN) and Twitter (NYSE: TWTR).

Since forming their first alliance in 2005, the 2 companies have moved in opposite directions, and Alibaba is now worth more than 5 times Yahoo's current market valuation of about US$46 billion. What's more, a big chunk of Yahoo's current value comes from its holding of 384 million Alibaba shares, which are worth about US$40 billion. Without its Alibaba shares, Yahoo would be a much smaller company in terms of market value.

All of that raises the intriguing prospect that Mayer could announce plans to sell Yahoo's remaining Alibaba stake, which could prompt Alibaba to engineer a deal that might ultimately see it buy the US company. Such a deal might see Alibaba join with some big institutional buyers to purchase its shares from Yahoo. Once that happens, Alibaba could then launch a bid for the remaining Yahoo.