The Italian job

The raging optimism of equity bulls was stopped in its tracks last week by shock Italian election results

Just when investors thought it was safe to get back into equities, the euro-zone crisis returned with a vengeance last week, with Europe's benjchmark Euro Stoxx 50 dropping 3 per cent on February 26, its worst daily loss since mid-2011. The severity of the correction following Italy's shock election results suggests the bulls were caught by surprise.

The question now becomes whether the equity bulls can recover their poise and continue to buy; or whether the "Italian job" has fatally undermined their carefully constructed optimism.

In other words, should we use the dip as a buying opportunity now or should we wait for further market consolidation?

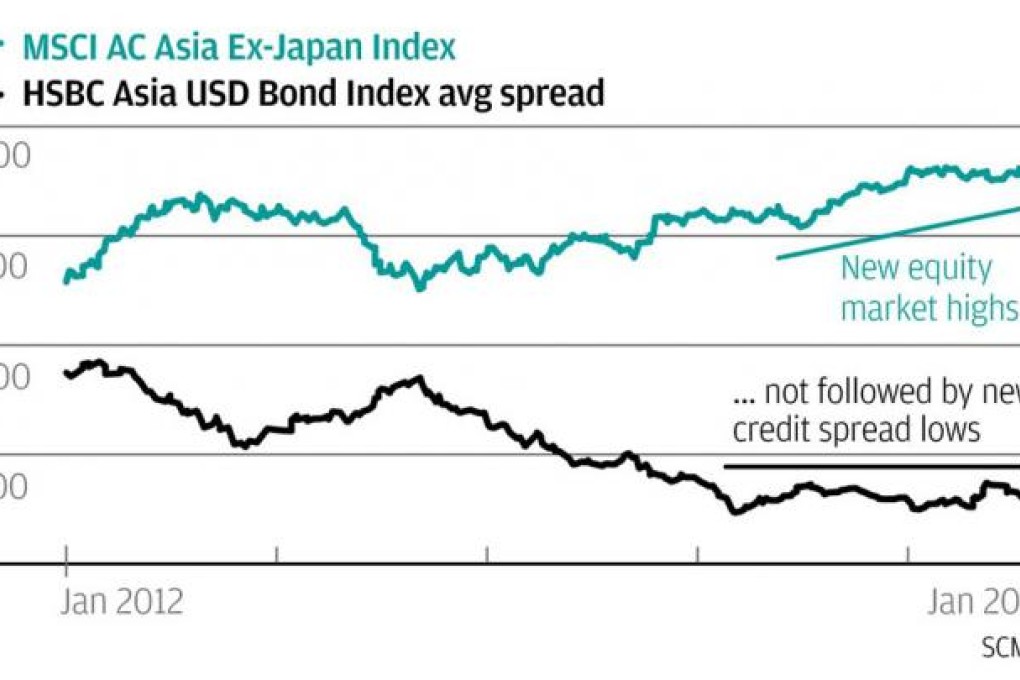

My view is that equities are set for a decline. But before I get to that, let us look at the bulls' case for optimism for stocks, be it the Hong Kong market or globally.

The base case is predicated on three compelling views: that mainland growth will accelerate; that central bank activism (read quantitative easing, money printing) in the United States, Europe and Japan will continue; and that the big macro risks that plagued 2011-12 - such as the mess that surrounded Greek elections and concerns over the US fiscal cliff - are diminishing.

Let's take each in turn. Mainland stocks took a hit last week with the unexpected slump in China's purchasing managers index (PMI), a keenly watched economic indicator. While a large part of the decline reflected seasonal distortions, the index also reflected a deeper-than-expected slowdown in output that analysts now believe could continue into the second quarter. One or two data points do not tell the full story about China's economy, but the decline reminded investors not to take the country's growth for granted.