Stock listings pencilled in for second half of 2013

Bankers see second half of 2013 as best time to relaunch mainland firms' postponed stock listings, once a new economic leadership team is in place

Many mainland companies that were forced to delay their listing plans in 2012 due to a weak market environment may find they are unable to relaunch their plans any time soon until some political uncertainties are resolved, bankers say.

China's once-in-a-decade leadership transition took place in mid-November in Beijing at the Communist Party's 18th congress. At the time the roles for top leaders, including president-in-waiting Xi Jinping, the current vice-president, and premier-in-waiting Li Keqiang, vice-premier at present, were effectively confirmed. However, financial industry executives say they are more keen to know who will be the new leaders in charge of economic, financial and securities matters.

"Different bosses have different ideas and preferences," said one banker. "Some want to accelerate reform of the financial industry and let more companies go public. Others may do things at a relatively slower pace."

Many market participants are optimistic about the outlook for new listings as they expect the stock markets in both Shanghai and Hong Kong to rebound once the new government is formed, which is most likely to be in early March when the fortnight-long National People's Congress is convened.

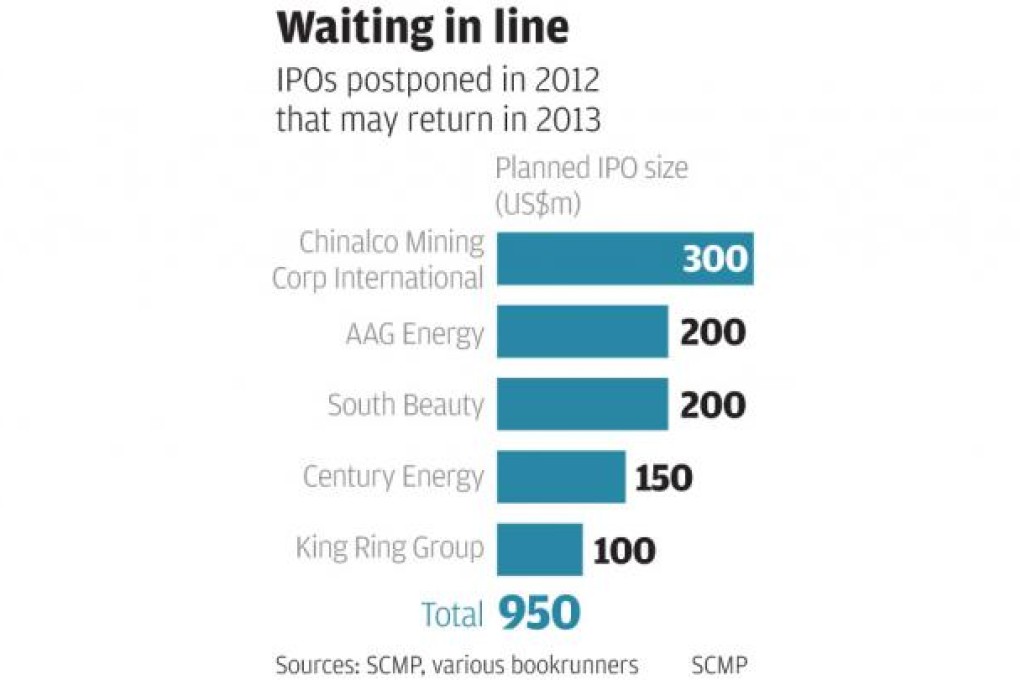

New policymakers are poised to revive the economy and the stock market, as well as the activities of initial public offerings (IPOs). But the question on investors' minds is how long those companies that delayed their IPO plans in 2012 will have to wait in 2013.

Investment bankers have suggested the second half of 2013, and not any point in the first six months, may be a more likely time for the best so-called market window in which to relaunch their IPO plans. For those who failed to list in 2012, they will also have to ask their IPO auditors to work on their new 2012 full-year financial disclosure to prepare for a listing in 2013; that heavy workflow also makes the second half of 2013 more likely as the busy season for new offerings.