Share offerings expected to gain momentum

Activity in listing market forecast to strengthen next year, with cornerstone investors playing a key role as the mainland economy rebounds

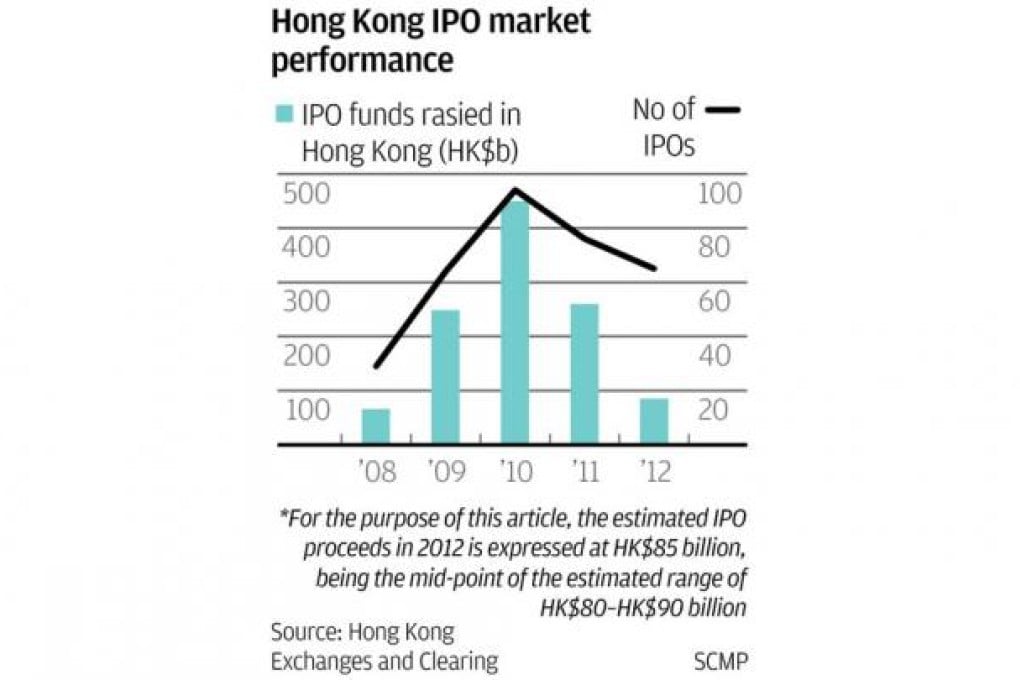

After hitting a four-year low this year, the initial public offering market in Hong Kong is expected to pick up in the second half of next year as the mainland economy rebounds, say Ernst & Young and KPMG.

The two leading professional services firms forecast private enterprises will fuel the upturn in listing activity. Not much contribution is foreseen from the traditional drivers, large state-controlled mainland companies, as many of them have already gone public in the past decade.

"The uptick in December could provide momentum into the first half of the coming year, largely because many of the measures to boost the economy will only be implemented after the [country's] leadership transition in March," said Ringo Choi, a partner at Ernst & Young.

"The best window for listing candidates should be very limited and be available in the second half of next year after the government policies take effect."

Choi said the average size of next year's listings would be up to HK$1 billion, with several power companies, renewable energy firms and property developers waiting in the queue for flotation.

On the role of cornerstone investors in future listings, he said their significance should continue next year because poor investor sentiment and lacklustre debut performances had dented retail demand for new shares.